Philippine businesses are entering the second quarter of 2025 with renewed optimism, despite a subdued outlook at the start of the year, according to the Bangko Sentral ng Pilipinas’ latest Business Expectations Survey (BES).

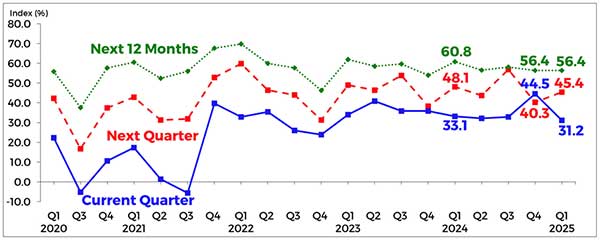

The overall confidence index (CI) for the first quarter of 2025 dropped to 31.2%, down sharply from 44.5% in the previous quarter, as firms expressed concerns over slower post-holiday demand and the possible return of inflationary pressures.

“The less upbeat outlook for Q1 2025 was mainly due to the expected decline in demand for goods and services after the holiday season and a slowdown in business activities,” the BSP stated in its report.

The downturn also reflected a rise in pessimism among firms and a reduction in the percentage of optimists.

However, business sentiment brightened for the next quarter.

The CI for Q2 2025 rose to 45.4%, up from 40.3% in the previous survey round, as companies anticipate a rebound in economic activity.

Confidence over the next 12 months remained steady, with the CI unchanged at 56.4%.

Sectoral analysis revealed that the downturn in optimism was broad-based, affecting all major economic sectors—industry, services, wholesale and retail trade—except for construction, which remained largely stable.

Trading firms, particularly exporters, dual-activity firms (those engaged in both importing and exporting), and domestic-oriented businesses, reported a decline in sentiment, while importers’ confidence remained relatively unchanged.

Firms reported tighter financial conditions in the first quarter, with the financial condition index becoming more negative.

Businesses also flagged concerns about credit access, as the credit access index reverted to negative territory, signaling anticipated constraints in borrowing.

On operational capacity, the average utilization rate for the industry and construction sectors fell to 71.4% in Q1 2025, from 73.9% in Q4 2024, indicating a slowdown in production and project activity.

Exchange rate expectations also shifted.

Businesses predicted a weaker Philippine peso against the U.S. dollar in Q1 and Q2, but expect the currency to appreciate over the next 12 months.

Borrowing costs are expected to rise during the same period, reflecting expectations of tighter monetary policy or market-driven interest rate adjustments.

Inflation expectations climbed across all reference periods.

Firms projected average inflation to reach 3.2% in Q1 2025, 3.3% in Q2, and 3.4% over the next 12 months—all within the government’s target range of 2.0% to 4.0% for 2025–2026.

The percentage of businesses anticipating higher inflation also increased compared to the Q4 2024 survey.

The survey, conducted from Jan. 8 to March 1, 2025, covered 1,527 firms nationwide, including 582 in the National Capital Region and 945 in areas outside NCR.

The nationwide response rate stood at 61.3%, slightly down from 61.5% in the previous quarter.

Despite near-term caution, the BSP’s findings reflect a business community that remains confident in the economy’s medium-term outlook, supported by a stable inflation environment and expectations of stronger demand ahead.