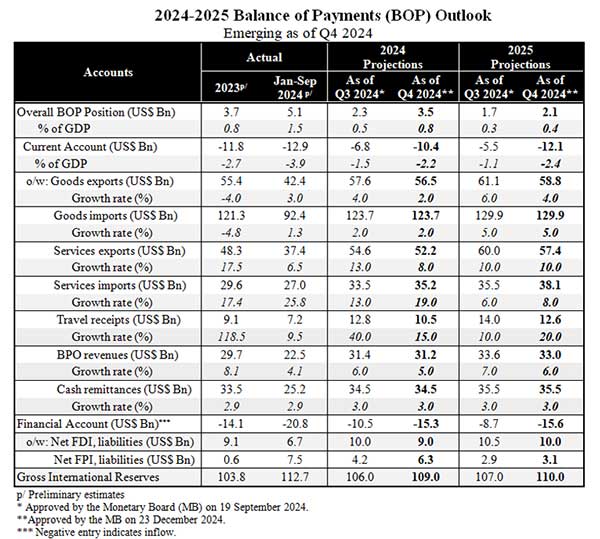

The Philippine balance of payments (BOP) position is expected to remain resilient in 2024 and 2025, bolstered by stable global and domestic economic trends, according to the latest forecasts.

While the BOP outlook reflects continued strength, the path for 2024 and 2025 shows a slight deceleration compared to the 2023 performance due to moderating global growth, geopolitical uncertainties, and weather-related shocks.

The Bangko Sentral ng Pilipinas (BSP) highlighted that while global economic growth is expected to moderate in 2024, advanced economies will continue driving momentum.

Domestic demand in the Philippines is anticipated to be a key growth driver, supported by easing inflation, declining oil prices, and the timely passage of the national budget.

Despite these positives, downside risks remain, including commodity price volatility, geopolitical tensions, slower-than-expected growth in China, and emerging constraints in artificial intelligence adoption.

The BSP emphasized that the current account deficit for 2024 is projected to narrow compared to 2023, although wider than earlier forecasts due to subdued export performance in goods and services.

Merchandise exports, particularly semiconductor products, copper, and bananas, saw notable slowdowns in 2024 amid tighter global monetary conditions and increasing trade barriers.

For 2025, the BOP is forecasted to stay in surplus, buoyed by sustained net inflows in the financial account despite the expected widening of the current account deficit.

The BSP noted the potential for global trade to improve in 2025 as inflation moderates and business activity picks up. However, uncertainties linked to U.S. trade and investment policies under the incoming Trump administration could impact the external sector.

Gross international reserves (GIR) are projected to continue growing in 2024 and 2025, underscoring the Philippines’ external resilience.

The BSP assured the public of close monitoring of emerging external risks to ensure the fulfillment of its price and financial stability objectives.