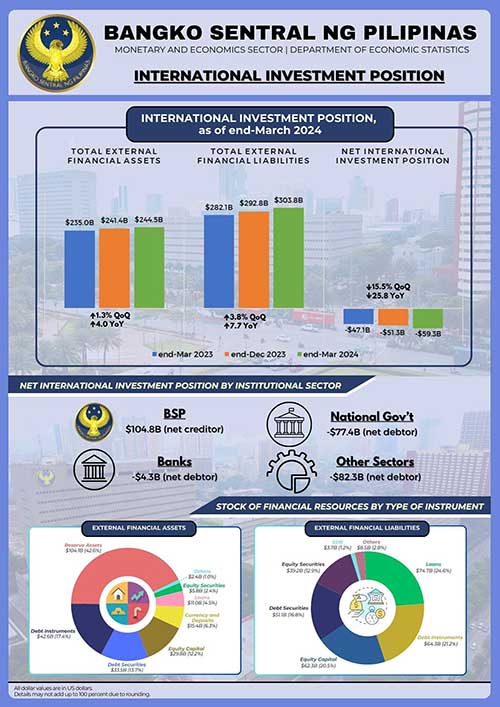

Preliminary data from the Bangko Sentral ng Pilipinas (BSP) shows the Philippines’ net external liability position reached $59.3 billion at the end of March 2024, marking a 15.5% increase from $51.3 billion in December 2023.

The rise is driven by a 3.8% growth in external financial liabilities, which outpaced the 1.3% growth in external financial assets.

As of March 2024, total external financial liabilities stood at $303.8 billion, while external financial assets were $244.5 billion.

Net foreign portfolio investment (FPI) saw a 5.3% increase to $90.3 billion due to transaction inflows and positive price revaluations.

Additionally, net foreign direct investment (FDI) grew by 3.3% to $126.6 billion, reflecting investor confidence in the Philippine economy amid improved domestic inflation dynamics.

Other investments, primarily loans, rose by 3.0% to $74.7 billion. On the asset side, residents’ net portfolio investments in debt securities increased by 7.0% to $33.5 billion, while direct investments in equity capital rose by 2.1% to $29.8 billion.

Year-on-year, the net external liability position expanded by 25.8% from $47.1 billion in March 2023. This was due to a 7.7% growth in total external financial liabilities, which outweighed the 4.0% increase in total external financial assets.

The growth in liabilities was driven by an 8.2% rise in net FDI to $126.6 billion, a 12.4% increase in other investments to $86.6 billion, and a 2.9% rise in net FPI to $90.3 billion.

Notably, nonresidents’ net investments in debt instruments and equity capital rose by 11.8% to $64.3 billion and 4.8% to $62.3 billion, respectively. Residents’ net outstanding loans from nonresident creditors saw a 15.7% increase to $74.7 billion. Portfolio debt securities investments by nonresidents grew by 4.5% to $51.1 billion.

The 4.0% annual growth in external financial assets was mainly due to a 5.2% increase in residents’ net direct investments abroad to $72.4 billion and a 2.5% rise in reserve assets to $104.1 billion.

The growth reflects the National Government’s net foreign currency deposits with the BSP, the BSP’s income from overseas investments, and adjustments in the BSP’s gold holdings and foreign currency-denominated reserve assets, excluding gold.

The BSP held 44.4% of the total external financial assets at $108.6 billion, slightly up from $108.5 billion in December 2023. Other sectors accounted for 41.2% of external financial assets at $100.9 billion, while banks held 14.3% at $35.1 billion.

In terms of liabilities, other sectors contributed 60.3% or $183.2 billion of the total, reflecting a 3.2% increase from December 2023.

The National Government recorded a 2.7% growth in external financial liabilities, reaching $77.4 billion, which constitutes 25.5% of the total.

Banks accounted for 13.0% at $39.4 billion, while the BSP held a marginal 1.3% at $3.8 billion, mainly in Special Drawing Rights (SDRs).

View Full Report here: https://www.bsp.gov.ph/Media_And_Research/International Investment Position/IIP1qtr2024.pdf