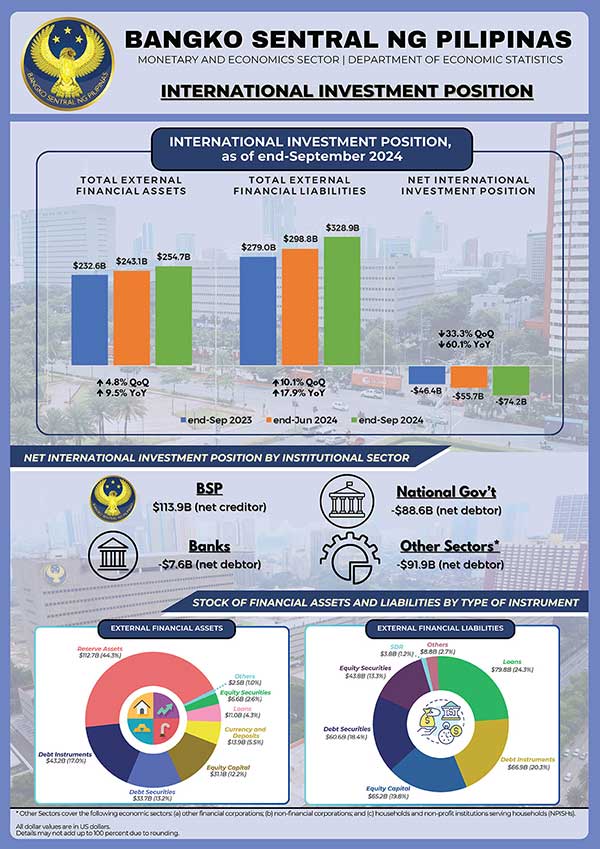

Preliminary data on the country’s net international investment position (IIP) indicated a net liability position of US$74.2 billion as of end-September 2024, higher by 33.3 percent than the US$55.7 billion recorded in end-June 2024.

This development was driven by the 10.1 percent expansion in the country’s external financial liabilities, which outpaced the 4.8 percent growth in external financial assets.

As of end-September 2024, the total outstanding external financial liabilities reached US$328.9 billion, while total outstanding external financial assets amounted to US$254.7 billion.

The country’s total stock of external financial liabilities as of end-September 2024 rose, as most components registered an increase, led by foreign portfolio investment (FPI).

Net FPI grew by 18.7 percent to US$104.4 billion (from US$87.9 billion) due to the notable increase in nonresidents’ outstanding investments in debt papers, particularly government securities (by 14.0 percent to US$60.6 billion from US$53.2 billion), and equity securities of local corporations. (by 26.0 percent to US$43.8 billion from US$34.8 billion).

The high demand for the newly issued government securities at competitive pricing reflected continued investor confidence in the country’s economic resilience, despite global challenges.

Meanwhile, nonresidents’ outstanding investments in equity securities rose due to upward valuation and additional inflows, mirroring the rise in the Philippine Stock Exchange Index (PSEi).

Positive investor sentiment was boosted by the country’s strong economic prospects amid interest rate cuts, a robust consumer sector, and healthy external payments position.

Moreover, net foreign direct investment (FDI) rose by 6.8 percent to US$132.1 billion from US$123.7 billion as nonresidents’ net investments in equity capital and debt instruments increased. Other investments also grew by 6.1 percent to US$92.1 billion from US$86.8 billion due to residents’ availment of foreign loans.

The country’s total stock of external financial assets expanded by 4.8 percent mainly on account of the country’s accumulation of reserve assets, which reached US$112.7 billion as of end-September 2024 (or an increase of 7.1 percent from US$105.2 billion).

The other factors that contributed to the expansion in total external financial assets were the combined growth in the residents’ net portfolio investments in foreign debt securities (by 7.2 percent to US$33.7 billion from US$31.4 billion) and net direct investments in debt instruments (by 3.3 percent to US$43.2 billion from US$41.8 billion) and equity capital of their foreign affiliates (by 1.7 percent to US$31.1 billion from US$30.6 billion).

On a year-on-year basis, the country’s net external liability position grew by 60.1 percent from US$46.4 billion as of end-September 2023. This was on account of the 17.9 percent growth in total external financial liabilities from US$279.0 billion, notwithstanding the 9.5 percent growth in total external financial assets from US$232.6 billion.

Total external financial liabilities expanded stemming from the collective increases in the following components: (1) nonresidents’ net investments portfolio debt securities (by 32.7 percent from US$45.7 billion) and equity securities (by 23.7 percent from US$35.4 billion); (2) loans extended by foreign affiliates to residents (by 18.8 percent to US$79.8 billion from US$67.2 billion); and (3) nonresidents’ net direct investments in equity capital (by 13.3 percent to US$65.2 billion from US$57.6 billion) and debt instruments (by 10.3 percent to US$66.9 billion from US$60.6 billion).

Meanwhile, the 9.5 percent annual growth in total external financial assets was mainly on account of the expansion in the country’s reserve assets (to US$112.7 billion from US$98.1 billion).

The other factors that contributed to the expansion in total external financial assets were the increases in residents’ net investments in equity capital (by 10.2 percent from US$28.2 billion), debt instruments (by 5.0 percent from US$41.1 billion), equity securities (by 25.7 percent from US$5.2 billion), and debt securities (by 4.0 percent from US$32.4 billion).

External Financial Assets

The BSP continued to hold the largest share of the country’s total external financial claims at 46.2 percent, valued at US$117.8 billion as of end-September 2024. This level was 7.4 percent higher than the US$109.7 billion asset holdings recorded in end-June 2024.

The said development was primarily driven by the 7.1 percent growth in the BSP’s gross international reserves (GIR), which constitute the majority of the BSP’s external financial holdings.

The Other Sectors accounted for 39.7 percent of the country’s outstanding external financial assets at US$101.1 billion.

The banking sector held the remaining 14.1 percent of the country’s total external financial assets amounting to US$35.8 billion.

External Financial Liabilities

The Other Sectors contributed the largest share to the country’s total external financial liabilities at 58.7 percent or equivalent to US$193.0 billion as of end-September 2024.

The 9.4 percent growth in the sector’s stock of external financial liabilities was mainly attributed to the increase in nonresidents’ net placements in portfolio equity securities to US$33.8 billion (from US$26.8 billion) and equity capital to US$61.2 billion (from US$54.4 billion).

The NG, likewise, recorded a 12.3 percent growth in its outstanding external financial liabilities to reach US$88.6 billion from US$78.9 billion as of end-June 2024.

The banking sector’s share accounted for 13.2 percent of the country’s total external financial liabilities at US$43.4 billion as of end-September 2024.

Meanwhile, the remaining 1.2 percent or equivalent to US$3.9 billion of the country’s total external financial liabilities was held by the BSP. This was mostly in the form of Special Drawing Rights (SDRs).

View Full Report here: https://www.bsp.gov.ph/Media_And_Research/International Investment Position/IIP3qtr2024.pdf