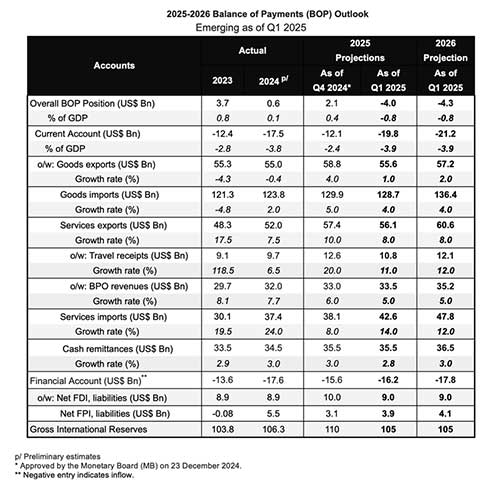

The Philippines’ balance of payments (BOP) is expected to remain in deficit in 2025 and 2026, as global economic uncertainty continues to dampen trade and investor confidence, the Bangko Sentral ng Pilipinas (BSP) said in its latest outlook.

A balance of payments is a country’s financial ledger that tracks all economic transactions with the rest of the world — including exports, imports, investments, and remittances. A BOP deficit means the country is spending more in foreign exchange than it is earning, which can affect the peso’s value and the country’s external stability.

The BSP attributed the projected deficit to a wider trade gap, slower growth in key export sectors, and global headwinds such as ongoing geopolitical tensions and changes in U.S. trade policies.

“Global growth prospects are expected to be further dampened by several factors, including the ongoing weakness in the Chinese economy, prolonged geopolitical tensions in conflict zones of the Middle East and Eastern Europe, and commodity price volatility,” the central bank said.

While the global economy is expected to remain sluggish through 2026, the Philippines’ domestic economy is forecast to continue expanding, offering a buffer against external risks. Private consumption, infrastructure investments, and business-friendly reforms are helping support growth, according to the BSP.

The trade outlook, however, remains mixed. Philippine exports of goods — particularly semiconductors — are expected to grow only modestly after declines in 2023 and 2024.

The semiconductor industry, which accounts for over half of Philippine exports, is still undergoing an “inventory correction,” meaning companies are adjusting from previous overproduction and shifting to meet changing global tech demands.

In the services sector, the business process outsourcing (BPO) industry — a key source of foreign earnings — is also facing headwinds.

Growth is expected to slow due to the U.S. government’s push to bring jobs back home and a local shortage of highly skilled workers in areas such as generative artificial intelligence (GenAI) and data analytics.

“These challenges may hamper industry efforts to climb up the value chain and maintain competitiveness,” the BSP noted.

Tourism is a bright spot in the services sector, with international arrivals from South Korea and Japan helping the industry recover to pre-pandemic levels.

Overseas Filipino worker (OFW) remittances, a stable source of dollar inflows, are projected to grow slightly below historical trends.

Middle Eastern countries like Saudi Arabia and Qatar are prioritizing local hiring, which could affect OFW deployment.

However, stricter U.S. immigration policies are expected to have limited impact on remittances from the U.S., since most Filipino migrants there are permanent residents or legally documented.

Despite the BOP challenges, the BSP expects sustained inflows of foreign investments — both direct and portfolio — to support the financial account. These inflows reflect investor confidence in the country’s economic fundamentals and ongoing reforms such as improved tax incentives, better ease of doing business, and enhanced capital market efficiency.

Another confidence booster is the Philippines’ expected exit from the Financial Action Task Force (FATF) Grey List, which currently flags jurisdictions with strategic deficiencies in anti-money laundering measures. Removal from the list would improve the country’s global financial reputation.

Still, the BSP warned that potential disruptions to U.S. interest rate policy, weaker world trade, and geopolitical tensions could weigh on the country’s external position. A pause in U.S. monetary policy easing could limit investment in emerging economies like the Philippines, reducing capital inflows.

The country’s gross international reserves (GIR) — the foreign currency stockpile used to stabilize the peso and cover imports — are expected to dip slightly in 2025 and 2026 due to lower foreign exchange earnings from exports and investments.

“The BSP continues to emphasize limitations to the forecasts, particularly given continued buildup of external challenges,” the central bank said, adding that it will closely monitor developments to fulfill its price and financial stability goals.