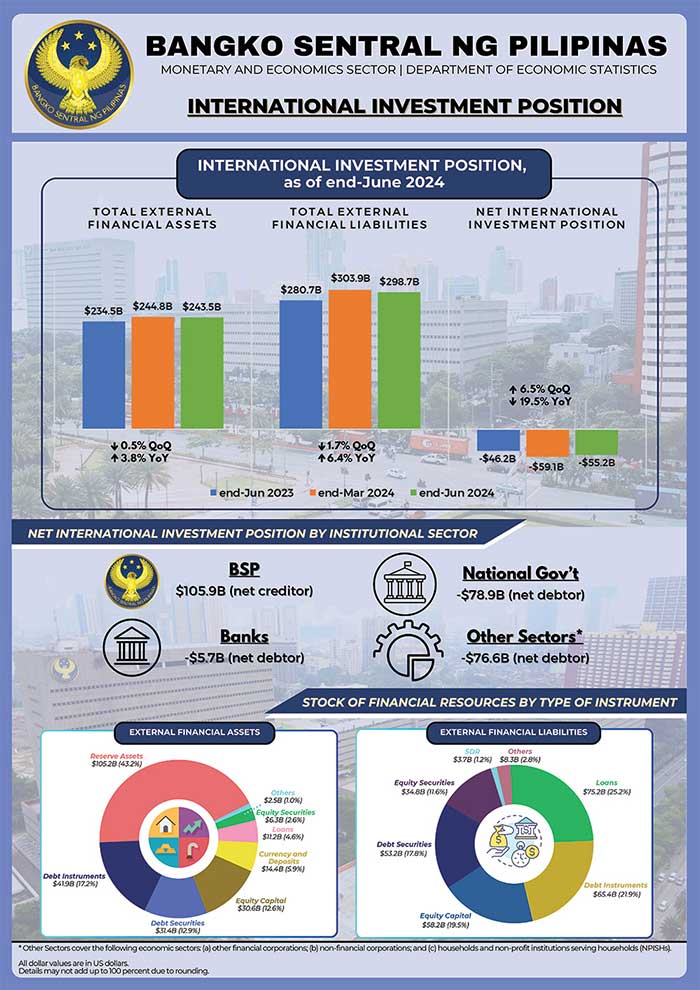

The Philippines’ net external liability position decreased by 6.5% to $55.2 billion by the end of June 2024, according to preliminary data released by the Bangko Sentral ng Pilipinas (BSP).

The latest figure is an improvement from the $59.1 billion recorded in March, driven by a contraction in the country’s external financial liabilities, which outpaced a smaller decline in external financial assets.

The decrease in liabilities was mainly due to declines in net foreign portfolio investments and net foreign direct investment, which saw downward valuation adjustments, a BSP report indicated.

Decline in Liabilities Outpaces Assets

The country’s total external financial liabilities shrank by 1.7% to $298.7 billion at the end of June.

Notably, net foreign portfolio investments in equity securities dropped by 11.3% to $34.8 billion, and net foreign direct investment in equity capital decreased by 6.5% to $58.2 billion.

These reductions, largely attributed to downward adjustments in the market, reflect the declining value of foreign investments in Philippine equities, which were influenced by a weaker Philippine Stock Exchange Index (PSEi), falling to 6,411.91 from 6,903.53 in March.

In contrast, the country’s external financial assets saw a more modest contraction of 0.5% to $243.5 billion.

The decline was driven primarily by reduced investments in foreign debt securities, which dropped by 6.2% to $31.4 billion, and a 3.1% reduction in foreign currency deposits by Philippine residents.

Year-on-Year Comparison: Liability Growth

Despite the quarterly improvement, the year-on-year picture shows a 19.5% increase in the Philippines’ net external liability position, from $46.2 billion in June 2023.

The rise was driven by a 6.4% increase in total external liabilities, which grew from $280.7 billion to $298.7 billion, primarily due to a surge in nonresidents’ loans to the Philippines and direct investments in debt instruments.

Nonresidents’ outstanding loans to Philippine entities rose by 16.1% to $75.2 billion, while direct investments in debt instruments grew by 10.9% to $65.4 billion.

These figures indicate a continued reliance on foreign borrowing and investment as a source of capital for Philippine businesses and government initiatives.

Meanwhile, the BSP noted a 3.8% growth in external financial assets year-on-year, rising from $234.5 billion to $243.5 billion, largely due to the accumulation of the country’s reserve assets, which include foreign currency deposits and gold holdings, rising by 5.8% to $105.2 billion.

The BSP highlighted that the national government’s foreign currency deposits and net income from foreign investments contributed significantly to this asset growth.

Sectors Driving the Financial Changes

The BSP continues to play a central role in managing the country’s external financial assets, holding 45% of the total, or $109.7 billion, by the end of June.

The private sector, classified as “Other Sectors,” accounted for 41%, or $99.7 billion, of external financial assets, while banks contributed 14%, or $34.1 billion.

On the liabilities side, the private sector also dominated, accounting for 59%, or $176.3 billion, of the country’s total liabilities.

The national government’s foreign debt stood at $78.9 billion, comprising 26.4% of total liabilities, while banks held 13.3%, or $39.8 billion.

View Full Report: https://www.bsp.gov.ph/Media_And_Research/International Investment Position/IIP2qtr2024.pdf