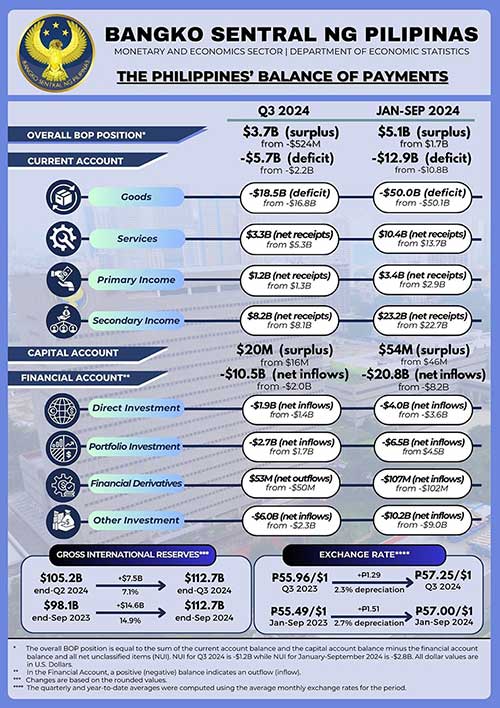

The Philippines’ balance of payments (BOP) position posted a surplus of $3.7 billion in the third quarter of 2024, a significant reversal from the $524 million deficit recorded in the same period last year, according to the Bangko Sentral ng Pilipinas (BSP).

The turnaround was largely driven by a sharp rise in net financial inflows, which offset the wider current account deficit during the period.

The current account deficit widened to $5.7 billion in Q3 2024, or -5.2 percent of gross domestic product (GDP), compared to $2.2 billion (-2.2 percent of GDP) in Q3 2023.

This increase stemmed from a larger trade in goods gap and lower net receipts in services and primary income, although higher net receipts in secondary income provided some relief.

The capital account posted net receipts of $20 million, up 19.4 percent from $16 million in Q3 2023, driven by higher revenues from gross disposals of nonproduced nonfinancial assets.

The financial account saw net inflows surge to $10.5 billion in Q3 2024, a fivefold increase from $2 billion in Q3 2023.

The rise was due to the reversal of portfolio investments from net outflows to net inflows, alongside increased inflows in direct and other investments.

For the January to September 2024 period, the BOP position recorded a surplus of $5.1 billion, nearly triple the $1.7 billion surplus recorded in the same period in 2023.

The financial account was the primary driver, with net inflows of $20.8 billion during the nine-month period, up from $8.2 billion in January to September 2023.

The increase was attributed to higher net inflows in portfolio, direct, and other investments.

Meanwhile, the current account deficit for January to September 2024 widened by 19.3 percent to $12.9 billion (-3.9 percent of GDP) from $10.8 billion (-3.5 percent of GDP) a year earlier.

This was mainly due to lower net receipts in services, partially offset by a narrower trade in goods deficit and higher primary and secondary income inflows.

The country’s gross international reserves (GIR) reached $112.7 billion as of end-September 2024, a significant rise from $98.1 billion a year ago.

The higher GIR provides an ample buffer against external shocks, equivalent to approximately 8.6 months’ worth of imports and payments of goods and services.

The peso averaged at P57.25 per US dollar in Q3 2024, appreciating slightly from P57.80 in the second quarter but weakening year-on-year by 2.3 percent compared to P55.96 in Q3 2023.

For the first nine months of 2024, the peso averaged P57.00 per US dollar, down 2.7 percent from P55.49 in the same period of 2023.

The BSP continues to monitor external developments and their potential impact on the country’s external accounts and exchange rate stability, with the aim of maintaining financial stability and resilience in an increasingly volatile global environment.