Digital fraud attempts in the Philippines peaked during the 2024 Black Friday sales, with 15% of all e-commerce transactions flagged as suspicious, according to an analysis by TransUnion.

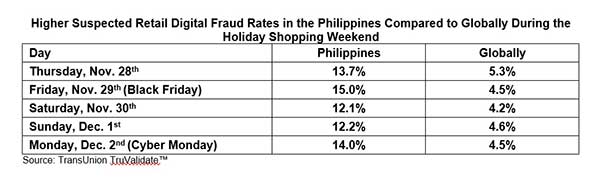

The five-day holiday shopping period, spanning November 28 to December 2, 2024, saw the Philippines record the highest rate of suspected retail digital fraud globally. The rate remained significantly above the global average, which stood at 4.6%.

Higher Suspected Retail Digital Fraud Rates in the Philippines Compared to Globally During the Holiday Shopping Weekend

“While we are encouraged to see a gradual decline in digital fraud rates within the Philippines market, these rates still significantly exceed the global rate,” said Yogesh Daware, chief commercial officer of TransUnion Philippines.

“This underscores the need for continued efforts from both public and private sectors to address the prevalence of digital fraud in the country.”

The holiday shopping season coincided with the release of bonuses such as the 13th month pay, making Filipino shoppers a prime target for fraudsters.

Filipinos are also highly aware of the risk, with 91% of respondents in TransUnion’s Q4 2024 Consumer Pulse Study expressing concerns about digital fraud—the highest rate among all surveyed countries.

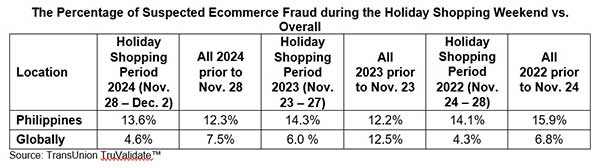

Over the entire holiday shopping weekend, 13.6% of e-commerce transactions in the Philippines were flagged as suspected fraud attempts.

This is a slight improvement from 14.3% during the same period in 2023 but remains 196% higher than the global rate.

The daily breakdown highlighted Black Friday as the riskiest day for shoppers in the Philippines, with 15% of transactions flagged.

Cyber Monday, November 2, followed with a 14% fraud rate. The global fraud rate, by comparison, dropped by 23% between 2023 and 2024, while the Philippines experienced only a 5% decline.

Despite high fraud rates, Filipino consumers are adopting more proactive measures to protect themselves.

An increasing number of individuals are regularly checking credit reports and monitoring accounts for unauthorized transactions.

“While consumers are taking steps to safeguard themselves, it is crucial for businesses to implement holistic fraud solutions to ensure consumer safety and maintain business integrity,” Daware added.

TransUnion’s analysis was based on data from its TruValidate fraud detection platform, which evaluates transactions against multiple indicators, such as real-time fraud denial and corporate policy violations.

Businesses and consumers are urged to remain vigilant during the holiday shopping season as fraudsters continue to target vulnerable buyers.