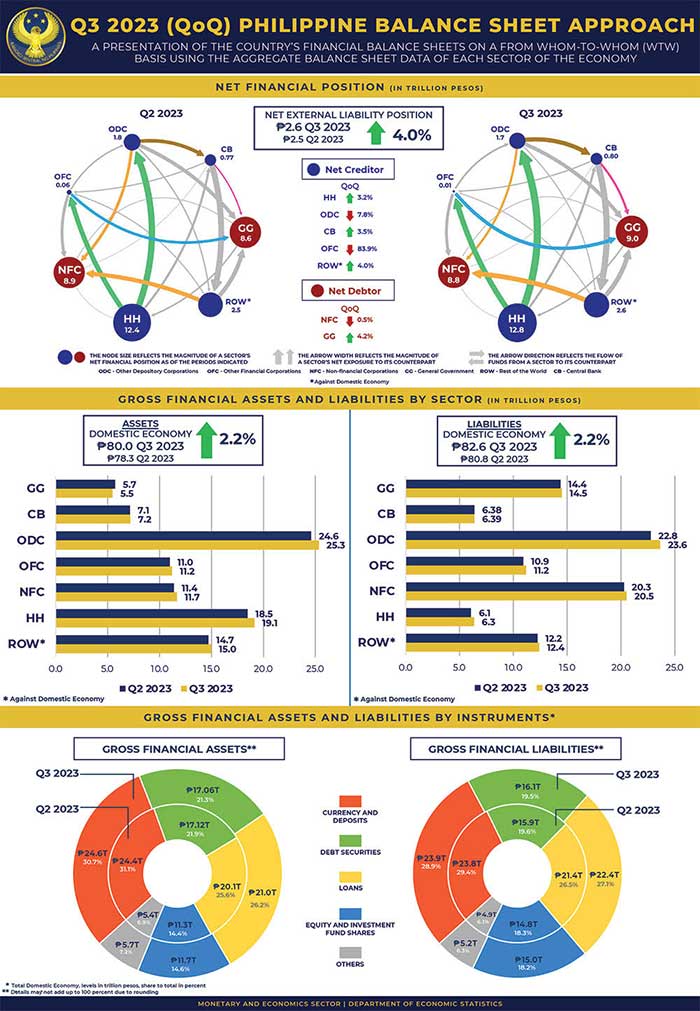

The Philippines witnessed a widening of its net external liability position by 4 percent in the third quarter of 2023, according to the latest Preliminary Balance Sheet Approach report.

The increase to P2.6 trillion from the second quarter’s P2.5 trillion was primarily attributed to the rise in net external liabilities of non-financial corporations.

Breaking down the sectors, the general government’s net financial liabilities saw a 4.2 percent rise to P9 trillion from P8.6 trillion over the quarter. This expansion is due to a reduction in the government’s central bank deposits, which were utilized for the repayment of domestic and foreign debts.

On an annual comparison, an overall increase in the general government’s financial liabilities was marked by elevated debt levels, a result of increased issuance of government securities and foreign loan availments. These factors outweighed the decrease in financial assets, largely due to diminished sector deposits in the central bank.

The non-financial corporations sector exhibited a slight 0.5 percent decrease in net financial liabilities quarter-on-quarter, settling at P8.8 trillion.

Despite this quarterly decrease, there was an annual broadening of the net liability position, driven by the sector’s augmented borrowings globally and increased issuances of equity and investment fund shares to international investors and other financial entities.

On the flip side, households demonstrated a solid financial standing with a 3.2 percent increase in their net financial assets, moving up to P12.8 trillion from P12.4 trillion quarter-on-quarter.

The households’ net claims on other depository corporations primarily fueled this growth, alongside increased holdings in equity and investment funds. This sector has maintained a creditor position yearly, bolstered by the growth in investments and deposit expansions.

However, the other depository corporations experienced a 7.8 percent quarter-on-quarter decline in net financial assets to P1.7 trillion, despite increased deposits from households and non-financial corporations. This was offset by these corporations’ greater holdings of debt securities issued by the Bangko Sentral ng Pilipinas (BSP) and their higher reverse repurchase agreements with the BSP.

From a year-on-year perspective, a decrease in the sector’s net financial assets was noted, largely due to the rise in household and corporate deposits.

The BSP itself saw a quarter-on-quarter rise in its net financial asset position by 3.5 percent to P795.3 billion, benefiting from reduced deposit liabilities to the government and the effects of the peso depreciation against the dollar, which amplified the peso value of its international reserves.

Contrastingly, the year-on-year outlook reveals a downturn, attributed to other depository corporations’ increased BSP debt security holdings and elevated reverse repurchase agreements.

This comprehensive report offers insights into the country’s financial stability and the economic movements influencing various sectors. It underscores the interplay between government debt management, corporate financing activities, household savings, and the overarching monetary policies by the BSP.

For more details, the Q3 2023 Philippine BSA report and statistical tables may be accessed through the following links:

Full Report: https://www.bsp.gov.ph/Media_And_Research/Philippine Balance Sheet Approach/BSA_3qtr2023.pdf

Statistical Tables: https://www.bsp.gov.ph/Media_And_Research/Media Releases/2024_03/news-03272024c1.xlsx