By Francis Allan L. Angelo

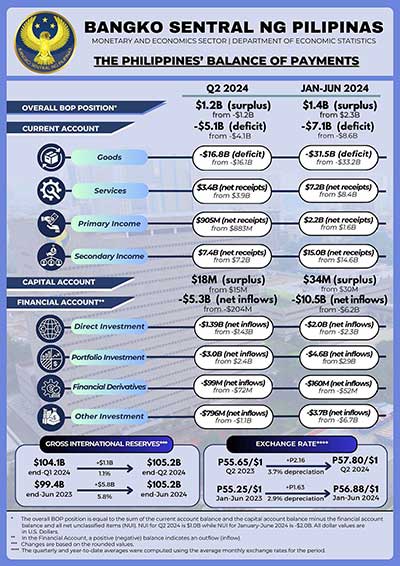

The Philippines’ balance of payments (BOP) position swung to a surplus of $1.2 billion in the second quarter of 2024, reversing a $1.2 billion deficit from the same period last year, according to data released by the Bangko Sentral ng Pilipinas on Friday.

The turnaround was mainly driven by higher net inflows in the financial account, despite an increase in the current account deficit.

The balance of payments is a comprehensive record of a country’s economic transactions with the rest of the world.

It includes all payments between residents of the country and foreign entities, covering trade in goods and services, cross-border investments, and financial transfers.

The BOP is composed of two main accounts: the current account, which tracks trade and income flows, and the financial account, which captures investments and borrowings.

A surplus indicates that more money flowed into the country than out, while a deficit means the opposite.

The current account deficit, which reached $5.1 billion (or -4.6% of GDP) in Q2 2024, was up by 25% compared to $4.1 billion (or -3.9% of GDP) in Q2 2023.

The widening deficit stemmed from an expanding trade in goods gap and lower net receipts in trade in services, though it was partially offset by higher income from primary and secondary income accounts.

The higher current account deficit reflects persistent challenges in trade and services, though it was cushioned by improved income receipts.

In contrast, the financial account, which measures the country’s net borrowing from the world, saw a significant increase, recording net inflows of $5.3 billion in Q2 2024—far higher than the $204 million net inflows in Q2 2023.

The sharp rise was attributed to the reversal of the portfolio investment account from outflows to inflows, along with continued strength in direct and other investment accounts.

For the first half of 2024, the BOP registered a surplus of $1.4 billion, although this was lower than the $2.3 billion surplus seen during the same period in 2023.

The sustained net inflows from the financial account contributed to the surplus.

Current Account Remains a Challenge

Despite the BOP surplus, the country’s current account deficit remains a concern.

For the first half of 2024, the deficit narrowed to $7.1 billion (or -3.2% of GDP), down 17.8% from $8.6 billion (or -4.1% of GDP) in the same period last year.

This improvement was driven by a reduction in the trade in goods deficit and higher net receipts in primary and secondary income accounts, though lower net receipts in trade in services tempered the gains.

Analysts warn that continued challenges in trade and services could weigh on the current account, with the global economic outlook still uncertain.

Capital and Financial Accounts Boost Surplus

The capital account, which recorded net receipts of $18 million in Q2 2024, showed a modest improvement from $15 million in Q2 2023.

For the first half of 2024, the capital account registered net receipts of $34 million, up by 13.5% from $30 million a year earlier.

Meanwhile, the financial account posted a robust performance, with net inflows of $10.5 billion in the first half of 2024, compared to $6.2 billion in the same period in 2023.

The surge was driven by the turnaround in portfolio investments and sustained inflows from direct and other investments.

Peso Weakens, Reserves Strengthen

Despite the positive BOP performance, the Philippine peso depreciated during Q2 2024, averaging P57.80 to the dollar, down 3.2% from P55.96 in the previous quarter.

Year-on-year, the peso weakened by 3.7% compared to P55.65 in Q2 2023.

On the positive side, the country’s gross international reserves (GIR) rose to $105.2 billion by the end of June 2024, up from $99.4 billion a year earlier, providing a significant buffer against external shocks.