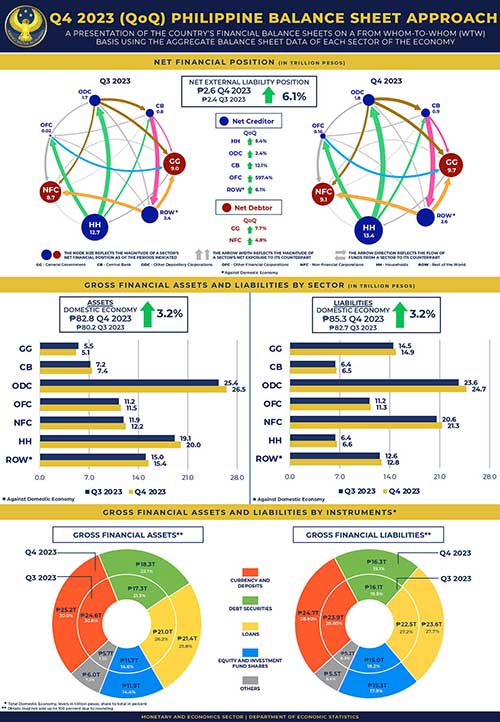

The Philippines’ net external liability position widened by 6.1% quarter-on-quarter to PHP 2.6 trillion in Q4 2023 from PHP 2.4 trillion in Q3 2023, according to preliminary data from the Bangko Sentral ng Pilipinas (BSP).

The increase is attributed to higher net external liabilities of the general government and non-financial corporations, offset by the BSP’s improved net external asset position.

The general government’s net financial liability position grew by 7.7% to PHP 9.7 trillion from PHP 9 trillion. This was driven by reduced national government deposits with the central bank, which were used for disbursements, local government allotments, and interest payments.

Additionally, the net debt position rose due to increased holdings of government securities by foreign entities, other depository corporations, and financial corporations.

Annually, the general government’s net financial liabilities increased as government securities held by various sectors and loans from non-residents grew.

Non-financial corporations saw a 4.8% increase in their net financial liability position, reaching PHP 9.1 trillion from PHP 8.7 trillion. This rise was due to higher loans from banks and non-residents, as well as increased non-resident holdings of equity and investment fund shares issued by these corporations.

On an annual basis, the sector’s liabilities expanded owing to higher loans from foreign sources and increased holdings of issued equity and investment fund shares by other financial corporations.

Households experienced a 5.4% increase in their net financial asset position to PHP 13.4 trillion from PHP 12.7 trillion, primarily due to increased bank deposits.

The sector also saw growth in holdings of currency, insurance, pension, standardized guarantee schemes, and equity and investment fund shares issued by other financial corporations.

Year-on-year, the households’ net financial asset position improved with higher investments in equity, investment fund shares, and other financial instruments issued by financial corporations.

The net financial asset position of other depository corporations rose by 2.4% to PHP 1.8 trillion from PHP 1.7 trillion, driven by higher loans to non-financial enterprises and increased placements in reverse repurchase agreements with the BSP and government-issued securities.

However, on an annual basis, the sector’s net financial asset position declined due to higher household deposits, increased external liabilities, and reduced external assets.

The BSP’s net financial asset position surged by 12.1% quarter-on-quarter to PHP 891.6 billion from PHP 795.2 billion, attributed to decreased deposits from the general government and an increase in net external assets.

Annually, the BSP’s net financial asset position widened due to the growth in the country’s gross international reserves.

These developments reflect the dynamic interactions among various sectors of the Philippine economy and their external financial engagements.

The increase in liabilities highlights the growing confidence of foreign investors in the country’s economic prospects, while the rise in assets indicates the strengthening of the domestic financial base.

For more details, the Q4 2023 Philippine BSA report and statistical tables may be accessed through the following links:

Full Report – https://www.bsp.gov.ph/Media_And_Research/Philippine Balance Sheet Approach/BSA_4qtr2023.pdf

Statistical Tables – https://www.bsp.gov.ph/Media_And_Research/Media Releases/2024_06/news-06282024f1.xlsx