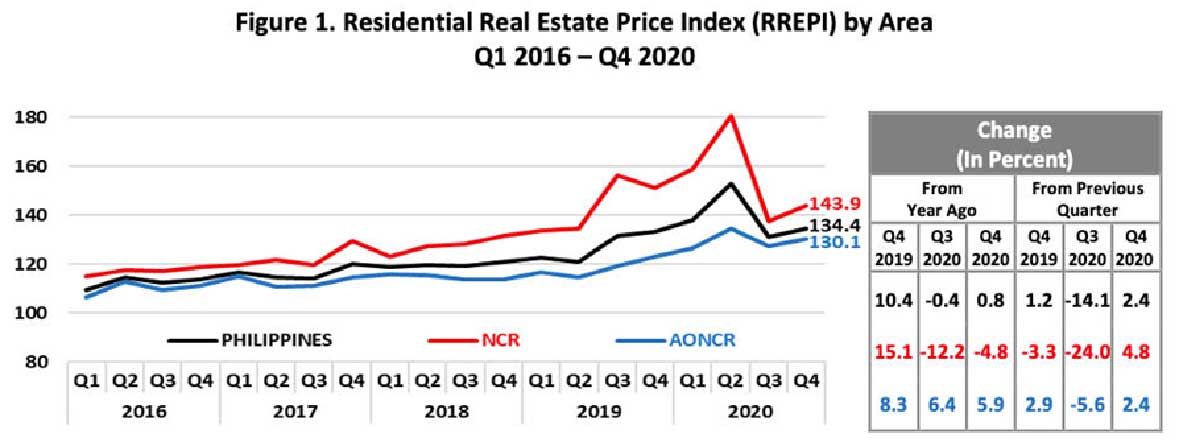

After a steep decline in the previous quarter, residential real estate prices of various types of new housing units in the Philippines recovered in Q4 2020 based on the Residential Real Estate Price Index (RREPI). House price growth reverted to the positive territory as RREPI rose by 0.8 percent year-on-year, and by 2.4 percent quarter-on-quarter (q-o-q). (Figure 1).

By area, residential property prices expand y-o-y in Areas Outside NCR (AONCR), but contract in NCR

The positive y-o-y growth in the overall residential property prices was driven mainly by those in AONCR, which grew by 5.9 percent relative to Q4 2019. Prices across all types of housing units in AONCR, except for the prices of condominium units, rose in Q4 2020. Meanwhile, the slump in property prices in the NCR continued for the second consecutive quarter, contracting by 4.8 percent in Q4 2020 (Figure 1). The decrease in the prices of condominium units in the NCR outweighed the increase in the prices of duplexes, townhouses, and single detached/attached houses. By contrast, house prices rose by 4.8 percent q-o-q in the NCR, tracking the national trend.

By category of housing units, residential property prices climb y-o-y across all types of dwelling, except for condominium units

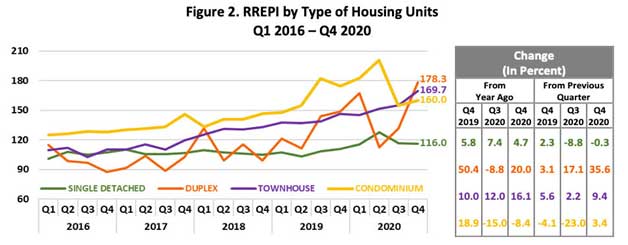

Prices of duplexes, townhouses, and single detached/attached houses rose in Q4 2020 by 20 percent, 16.1 percent, and 4.7 percent, respectively, while prices of condominium units contracted by 8.4 percent in Q4 2020. This is the second consecutive quarter that condominium prices declined. The decrease in the prices of condominium units in both NCR and AONCR may be attributed to the postponement of new launches by developers and lackluster demand for transient dwelling amid the pandemic. Meanwhile, the q-o-q growth of 2.4 percent in the RREPI was accounted for by higher prices of duplexes, townhouses, and condominium units, which more than offset the marginally lower prices of single detached/attached houses (Figure 2).

Residential real estate loans for new housing units decline y-o-y, but rise q-o-q in Q4 2020

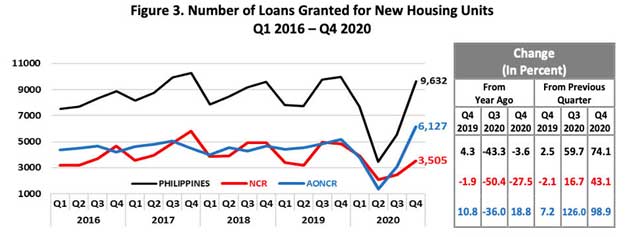

In Q4 2020, the number of RRELs granted for all types of new housing units in the Philippines declined by 3.6 percent y-o-y, but rose by 74.1 percent q-o-q. A similar trend was observed in NCR. In AONCR, the increase in the number of RRELs granted was registered for both y-o-y and q-o-q (Figure 3).

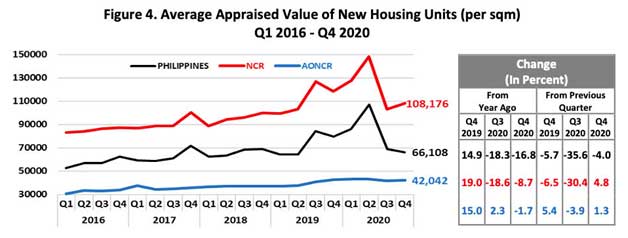

The average appraised value per sqm of new housing units in the country contracted by 16.8 percent y-o-y and 4 percent q-o-q. In both NCR and AONCR, the average appraised value per sqm of new properties was lower y-o-y, but nonetheless higher q-o-q (Figure 4). By type of new dwellings, lower average appraised value per sqm was registered in condominium units y-o-y and single detached/attached houses q-o-q.

Profile of residential real estate loans in Q4 2020

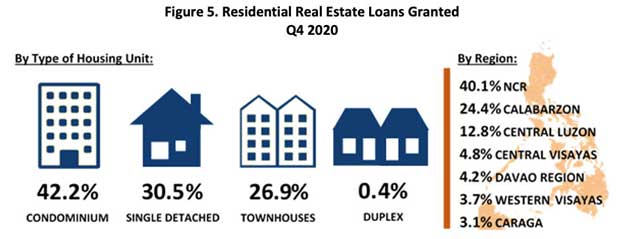

In Q4 2020, the purchase of new housing units accounted for 83.4 percent of residential real estate loans (RRELs). Meanwhile, by type of housing unit, most of the residential property loans were used for the acquisition of condominium units (42.2 percent), followed by single detached/attached houses (30.5 percent) and townhouses (26.9 percent), as shown in Figure 5. As noted in Q4 2020, the number of loans granted for the purchase of townhouses registered the largest y-o-y expansion on account of the 253.3 percent increase in AONCR.

Most of the RRELs granted in NCR were for the purchase of condominium units, while RRELs granted in AONCR were for the purchase of single detached/attached houses. By region, 40.1 percent of the total number of RRELs granted were from the NCR, while the rest were distributed in AONCR―CALABARZON (24.4 percent), Central Luzon (12.8 percent), Central Visayas (4.8 percent), Davao Region (4.2 percent), Western Visayas (3.7 percent), and Caraga (3.1 percent). NCR and the said six regions combined accounted for 93.1 percent of total housing loans granted by banks (Figure 5).

The RREPI is a measure of the average change in the prices of various types of housing units, i.e., single detached/attached houses, duplexes, townhouses and condominium units, based on banks’ data on actual loans granted to acquire new housing units only. It is a chain-linked index, which is computed using the average appraised value per square meter, weighted by the share of floor area of each type of housing unit to the total floor area of all housing units. The RREPI is used as an indicator for assessing the real estate and credit market conditions in the country. The BSP has been releasing the report since Q1 2016.

Data for the RREPI are obtained through BSP Circular No. 892 dated 16 November 2015, which requires all universal/commercial banks (UBs/KBs) and thrift banks (TBs) in the Philippines to submit to the BSP a quarterly report on all RRELs granted.