A criminal complaint was lodged before the Office of the Ombudsman in Iloilo City on Monday against Energy Secretary Alfonso Cusi, Davao-based businessman Dennis Uy and 10 others for alleged anomalies in the sale of Chevron Philippines’ shares in the Malampaya gas-to-power project to Uy’s enterprise.

The complaint was filed by Bacolod City-based geologist Balgamel de Belen Domingo, lawyer Rodel Rodis, and businesswoman Loida Nicolas Lewis, who are both based in the USA, according to their counsel Rico Domingo during the virtual Liga ng mga Brodkaster sa Pilipinas’ forum on Tuesday.

The complaint also implicated former and current officials of state-run Philippine National Oil Co.-Exploration Corp. (PNOC-EC) and Chevron Philippines officials.

The complainants said they are “concerned citizens who advocate for the Filipino people’s right to energy security, which includes the Malampaya Deep Water Gas-to-Power Project, a major energy source which delivers a fifth of the country’s rapidly growing electricity needs.”

The three complainants claimed that the respondents violated Republic Act No. 3019 (Anti-Graft and Corrupt Practices Act).

They alleged that Cusi and other respondents conspired to give “unwarranted benefits and advantage” to Uy’s Udenna Corp. and its subsidiary, UC Malampaya PHL, in the sale of Chevron’s share and transfer of rights in the Malampaya project, “thereby causing undue injury to the Government.”

“Despite knowledge of its right to match UC Malampaya’s offer and the anticipated good returns of the investment in Chevron’s share, PNOC-EC failed to exert any effort to purchase Chevron’s participating shares,” the complaint read.

They also accused the DOE under Cusi of failure to perform due diligence before clearing the deal.

Cusi had said the Uy-Chevron transaction was not a “midnight deal” as “it’s beyond our (DOE’s) purview.”

In an emailed statement, Udenna said it has yet to receive the supposed complaint filed before the Office of the Ombudsman and has learned about it only through media reports.

“At the proper time and venue, we will address all allegations raised against the company to prove that everything is done aboveboard. At this juncture, we maintain that the acquisition of UC Malampaya Phils. Pte., Ltd. (UCMP) of the shares of Chevron Philippines in Chevron Malampaya LLC is within the parameters of the law,” the statement added.

The Davao-based Dennis Uy owns Phoenix Petroleum and was one of the biggest campaign donors of President Rodrigo Duterte in 2016.

The case stemmed from UCMP’s acquisition of the shares of Chevron Malampaya LLC, which had a 45% stake in the Malampaya gas field, in 2019.

The Department of Energy (DOE) approved the UCMP-Chevron deal in April 2021 after evaluating the technical, financial, and legal capability of the Uy-led firm.

Former PNOC president Eduardo Mañalac said the government forfeited billions of pesos in profits when it allowed UCMP to buy a 45% stake in the project from Chevron.

“If the government acquired the shares, it could have taken up to ₱138 billion. Because neither government nor PNOC took the shares, we lost that amount,” the report quoted Mañalac as saying.

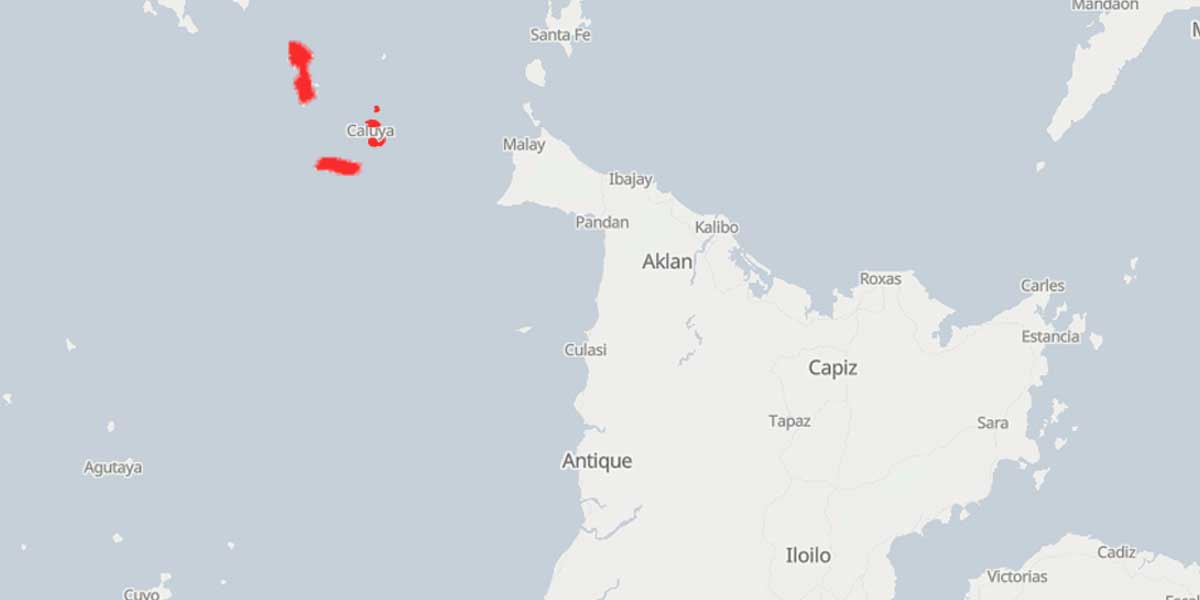

According to a CNN Philippines report, the government tapped private service contractors to explore the waters off Palawan for gas deposits since 2001.

The natural gas extracted from the project currently supplies over 20 percent of the country’s power needs, with the government earning 60 percent from revenues and the remaining 40 percent for its private partners.

Shell Exploration BV and Chevron each owned a 45 percent stake in the project, with the remaining 10 percent maintained by the state through PNOC-EC.

Both Chevron and Shell sold their shares in the project to UCMP, giving it a 90% controlling stake.

Mañalac said that without UCMP’s buyout, the government could have received an additional ₱42 billion if it took control for the remaining three years of the Malampaya contract – and could be higher given the recent surge in global oil prices. (With reports from GMA News and CNN PHL)