By Atty. Eduardo T. Reyes III

By Atty. Eduardo T. Reyes III

PONZI must have a multitude of faces.

The lure of get-rich-quick-schemes still never fails to captivate since 1919 up to today. It must be as tempting as an illicit affair that people cannot seem to resist to take the plunge.

Reeling from the ill-effects of Covid-19 that obstinately persists and does not appear to be evaporating soon, people are desperate to invest in vehicles that promise to yield high returns in so short a period of time. Perhaps a parched throat will always chase the water even if it would turn out to be a mirage.

If a person decides to part with his/ her hard-earned money to place it in such kinds of “investments” which turn out to be untrue and the agent who received the money promises to return the same, will the act of restoring the money put an end to all the legal troubles?

The answer lies in the distinction between a loan and estafa. A loan is an act of borrowing money with the obligation of returning the same amount plus interest if agreed upon in writing. Estafa, on the other hand, may also involve some money to be returned within a certain period of time; but the difference is that in estafa, the owner of the money parted with it either because of the employment of deceit or the failure to return the money is done with abuse of trust or confidence.

In short, the failure to pay a loan will only give rise to a civil case for collection of sum of money that does not carry with it imprisonment as penalty; while the failure to return the money when attended by deceit or abuse of confidence constitutes estafa that entails some jail time upon conviction.

When a get-rich-quick-scheme is presented in a different hue or shade, and is being passed off as legitimate (even if not), telling the difference could sometimes be difficult especially to the untutored in law.

Estafa has essential ingredients which the Supreme Court had reiterated in the very recent case of Martin N. Lim, Jr. v. Maria Concepcion D. Lintag, G.R. No. 234405, December 9, 2020, viz:

“The elements of Estafa under Article 315, paragraph I(b) are: (1) the offender’s receipt of money, goods, or other personal property in trust, or on commission, or for administration, or under any other obligation involving the duty to deliver, or to return, the same; (2) misappropriation or conversion by the offender of the money or property received, or denial of receipt of the money or property; (3) the misappropriation, conversion or denial is to the prejudice of another; and (4) demand by the offended party that the offender return the money or property received.

X x x

First. The trust receipt covering the July 23, 2003 transaction unequivocally shows the fiduciary relationship between the parties. Arrivas was entrusted with the diamond ring with the specific authority to sell the same, and the corresponding duty to return it, or the proceeds thereof should it be sold, within two days from the time of the execution of the receipt. These matters were admitted by Arrivas during trial.

Second. Arrivas failed to return the ring, or the proceeds thereof, within the period agreed upon in the trust receipt, and even after a written demand. The failure to account upon demand, for funds or property held in trust, is circumstantial evidence of misappropriation.

Third. Arrivas’s failure to return the subject ring or its value, despite demand, resulted to the damage and prejudice of Bacotoc.

Lastly. Oral and written demands were made by Bacotoc to the petitioner.”

Also in the same case, the Court pointed out the special feature called “juridical possession” that sets estafa apart from a mere collection of sum of money case that does not require the same. In estafa, the element of “juridical possession” means that “an agent has material and juridical possession of the thing received because he can assert, as against his own principal, an independent, autonomous right to retain the money or goods received in consequence of the agency; as when the principal fails to reimburse him for advances he has made, and indemnify him for damages suffered without his fault.”

Thus, for instance, when an “investor” parks his/ her money with the “agent” who promises to “double his/ her money” in a short period of time, the “agent” acquires juridical possession and the failure to return the money will amount to estafa.

Now, what happens when the “agent” promises to return, if not actually returns the money “invested”, will such act blunt an estafa charge and save the “agent” from being prosecuted criminally?

This leads to another principle known as “Novation”.

“Novation is defined as the extinguishment of an obligation by the substitution or change of the obligation by a subsequent one which terminates the first, either by changing the object or principal conditions, or by substituting the person of the debtor, or subrogating a third person in the rights of the creditor.

Article 1292 of the Civil Code on novation further provides:

Article 1292. In order that an obligation may be extinguished by another which substitute the same, it is imperative that it be so declared in unequivocal terms, or that the old and the new obligations be on every point incompatible with each other.

It is well settled that novation is never presumed – novatio non praesumitur. As the party alleging novation, the onus of showing clearly and unequivocally that novation had indeed taken place rests on the petitioner”. (Diosa Arrivas v. Manuel Bacotoc, Ibid).

Novation therefore could be the last legal detour that the “agent” could still take to obviate criminal prosecution. But it requires that there must be a clear and unmistakable agreement between the “investor” and the “agent” that the money returned had fully satisfied the former beyond just mere appeasement. The agreement must also be reached before the estafa case is lodged in court.

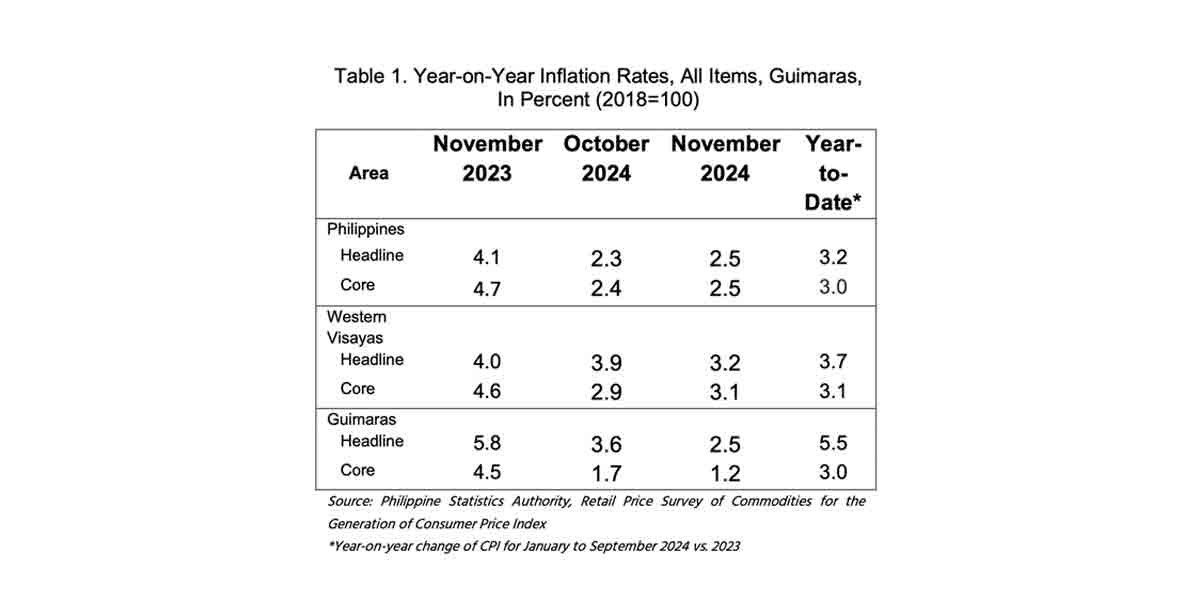

The pitfalls of investing may have been brought to the fore here. But this is not to say that all investing is bad. For keeping your money inert in some treasure chest may not also be advisable as the threat of inflation may poke its ugly head and rob your money of its potential economic value. Perhaps risks are unavoidable after all. We just have to make sure that the risks we take are calculated.

In the words of Niccolo Machiavelli in “The Prince”, “All courses of action are risky, so prudence is not in avoiding danger (it’s impossible), but calculating risk and acting decisively. Make mistakes of ambition not mistakes of sloth. Develop the strength to do bold things, not the strength to suffer.”

(The author is the senior partner of ET Reyes III & Associates– a law firm based in Iloilo City. He is a litigation attorney, a law professor and a law book author. His website is etriiilaw.com).