The year 2024 began on a more positive note compared to the past two years, which were disrupted by the lingering effects of the pandemic, geopolitical tensions from Russia’s invasion of Ukraine, and a banking crisis in the United States.

However, the first quarter of 2024 has witnessed a slowdown in US activity, with emerging markets playing a pivotal role in sustaining global economic momentum.

Despite these headwinds, credit insurer Coface has adjusted its assessments for several countries and sectors, indicating a short-term favorable outlook. This includes upgrading the outlook for four countries while downgrading one, and revising the ratings for 26 sectors—20 upgrades and six downgrades.

Global growth and sectoral shifts

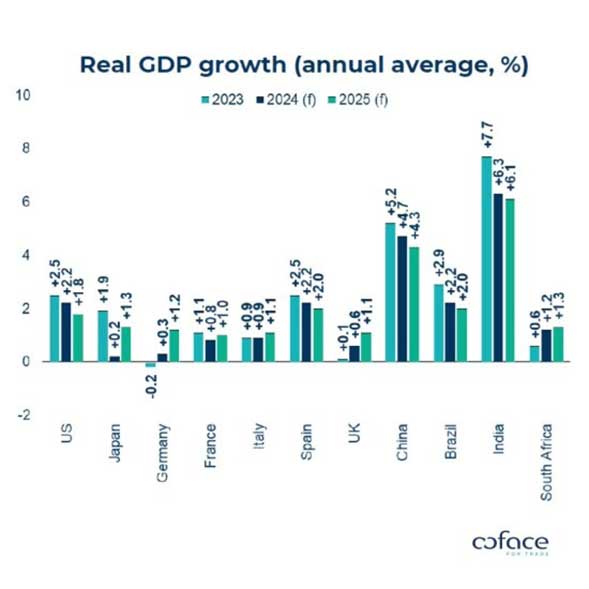

Coface’s global growth forecast for 2024 has been revised upward to 2.5%, with stabilization anticipated at 2.7% in 2025. The moderate growth in the US and China is expected to be balanced by accelerated expansion in emerging markets.

The labor market in the US has returned to pre-pandemic levels, signifying a better equilibrium between labor supply and demand.

In China, the economic rebound has been uneven, with GDP exceeding expectations in the first quarter of 2024 due to increased manufacturing investments, despite concerns about production overcapacity.

Europe has shown signs of recovery with a GDP growth of 0.3% in the first quarter of 2024, primarily driven by the services sector. This suggests that the region might be moving out of recession.

Disinflation challenges persist

The disinflation process in the United States remains challenging, particularly due to the persistent high costs of services and housing.

The PCE* inflation stands at 2.7%, above the Federal Reserve’s target of 2%, underscoring the difficulty of the final phase in the fight against inflation. Similarly, in Europe, inflation rebounded to 2.6% in May from 2.4% in April, primarily due to slowing prices of unprocessed food and goods. Wage increases are likely to boost consumption but may also slow disinflation efforts.

Emerging markets

Emerging economies are set to experience significant growth, although their pace may be constrained by the Federal Reserve’s cautious approach to rate cuts.

While markets anticipate one or two rate cuts, these are expected to occur towards the end of the summer or later. In contrast, the European Central Bank has already initiated monetary easing with a 25 basis points cut in early June.

Emerging markets, such as Brazil, have slowed their rate-cutting cycles to prevent inflationary pressures from imports.

Despite the Fed’s cautious timeline, several regions are expected to see robust growth.

Southeast Asian countries like Vietnam and the Philippines are forecasted to grow at over 6%, while India is projected to achieve 6.1% growth. African economies are also poised for acceleration, with major economies like Nigeria, Egypt, Algeria, Ethiopia, and Morocco expected to exceed 4% growth.

Potential trade war escalation

The US has raised customs duties on Chinese imports, signaling a continued strategic counter to China. The European Union has followed suit, imposing tariffs up to 38% on Chinese electric vehicles.

Other countries, including India and Brazil, have adopted similar measures, raising concerns about increased global trade tensions.

These developments suggest that Mexico and Vietnam might benefit from the reorganization of global trade, although it remains too early to determine a complete decoupling between the US and China.

Furthermore, campaign promises from candidate Donald Trump to implement global tariffs of 10% have exacerbated concerns about US trade policies, potentially leading to higher business costs and an inflationary outlook.

In summary, while the global economy shows signs of resilience with revised growth forecasts and sectoral upgrades, ongoing geopolitical and economic uncertainties present significant challenges. Policymakers and businesses will need to navigate these complexities to sustain growth and mitigate risks.

Link to the full report: https://www.coface.com/content/download/57984/file/Barometer%20T2%202024%20-%20turbulence%20ahead%20-%20ENG.pdf

*The PCE (Personal Consumption Expenditures) index is the US Federal Reserve’s preferred inflation barometer. PCE takes into account price data supplied by companies, not consumers.