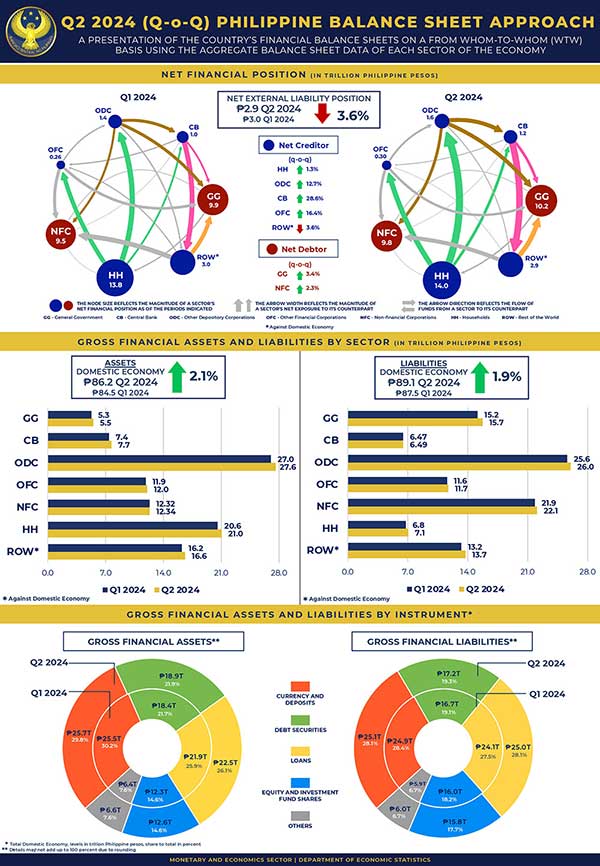

The Philippines’ net external liability position improved in the second quarter of 2024, easing by 3.6 percent to PHP 2.9 trillion from PHP 3 trillion in the first quarter.

This improvement was attributed to the higher net external asset position of the Bangko Sentral ng Pilipinas (BSP), despite increased liabilities of the general government.

The general government’s net financial liabilities rose 3.4 percent quarter-on-quarter to PHP 10.2 trillion due to additional foreign financing through debt securities and loans. The sector also experienced lower deposits with the BSP, which contributed to the increase.

“The rise in government securities held by other depository corporations and non-residents reflects continued demand for these instruments,” the BSP stated.

Non-financial corporations saw their net financial liabilities expand by 2.3 percent quarter-on-quarter to PHP 9.8 trillion. This increase was driven by higher loans payable to depository corporations and reduced bank deposits.

Households remained the largest net financial asset holders, with their position rising 1.3 percent to PHP 14 trillion in Q2. This was fueled by increased bank deposits and investments in equity and investment funds.

The BSP noted, “Household resilience is evident through growing financial assets, supported by robust banking activity.”

The net financial asset position of other depository corporations increased by 12.7 percent to PHP 1.6 trillion due to higher loans receivable and investments in government securities.

The Central Bank’s net financial assets grew significantly by 28.6 percent to PHP 1.2 trillion. This growth was attributed to its expanded investments in foreign debt securities and deposits in international banks.

The BSP highlighted that the improvement in external liabilities reflects the country’s stable economic fundamentals.

“We are leveraging increased international reserves to strengthen the economy’s financial position,” it added.