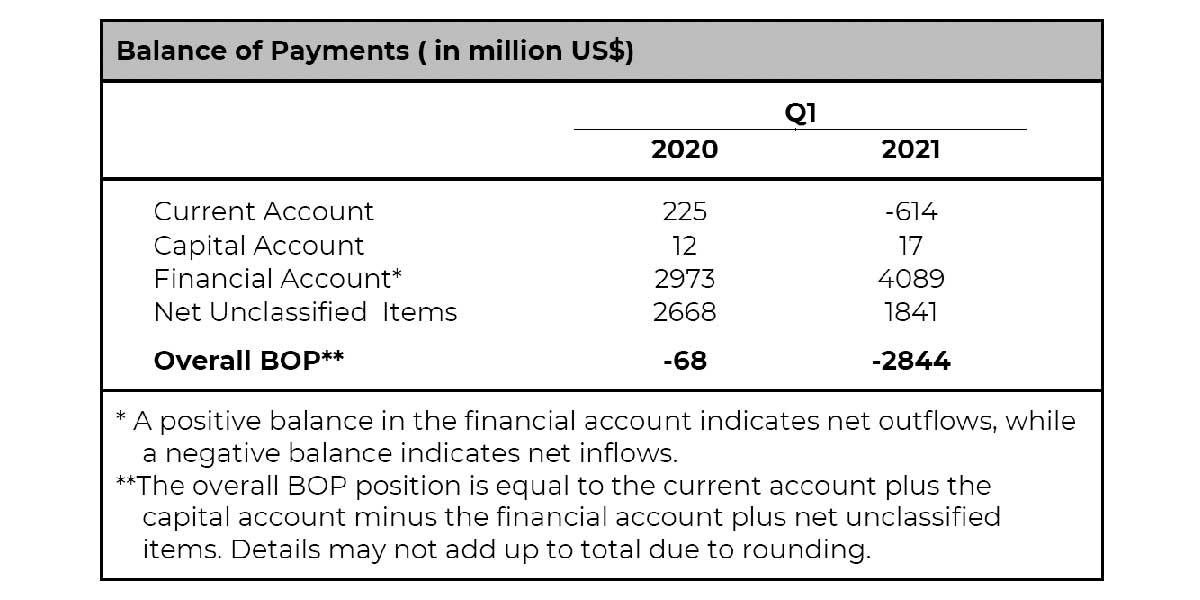

The increase in the BOP deficit stemmed from the uptick in net outflows in the financial account, coupled with the reversal of the current account from a surplus to a deficit during the period.

The increase in net outflows in the financial account emanated mainly from the portfolio investment account, primarily due to the rise in the Central Bank’s net investments in non-reserve assets as well as the Government’s and Other Sectors’ higher net repayments of maturing bond issuances.

Meanwhile, the current account reversed to a deficit as the merchandise trade gap widened on account of the growth in imports amid the gradual reopening of the domestic economy due to the easing of COVID-19 containment measures. Lower net receipts of primary income also contributed to the current account deficit.

Current Account. The current account posted a deficit of US$614 million in Q1 2021, a reversal from the US$225 million surplus recorded in the same quarter in the previous year. This developed on account of the widening of the trade in goods deficit coupled with the drop in net receipts recorded in the primary income account.

Capital Account. Net receipts in the capital account rose to US$17 million in Q1 2021 from US$12 million in Q1 2020. This resulted from the lower gross acquisition of non-produced non-financial assets (e.g., patents, trademarks, and copyrights).

Financial Account. The financial account posted net outflows of US$4.1 billion in Q1 2021, 37.5 percent higher than the US$3 billion net outflows registered in the same quarter last year. This developed mainly on account of the substantial increase in net outflows of portfolio investments to US$7.9 billion from US$793 million. These net outflows were tempered by the reversal of other investments to net inflows and the increase in net inflows of direct investments.

Gross International Reserves

The country’s gross international reserves (GIR) amounted to US$104.5 billion as of end-March 2021, significantly higher than the US$88.9 billion level registered as of end-March 2020. At this level, the reserves adequately covered 11.9 months’ worth of imports of goods and payments of services and primary income. It was also equivalent to 7.7 times the country’s short-term external debt based on original maturity and 5.3 times based on residual maturity.

This year-on-year increase in reserves reflected inflows from the BSP’s foreign exchange operations and income from its investments abroad, and the National Government’s net foreign currency deposits with the BSP. Further, an upward adjustment in the value of the BSP’s gold holdings due to the increase in the price of gold in the international market also contributed to the higher GIR level.

Exchange Rate

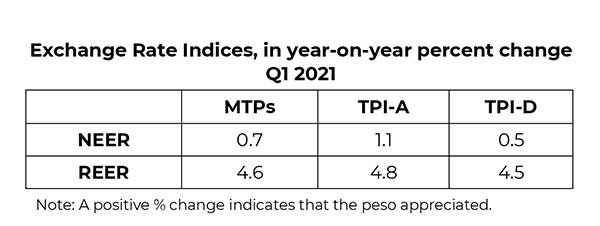

For the first quarter of the year, the peso appreciated against the baskets of currencies of major trading partners (MTPs) and trading partners in advanced (TPI-A) and developing (TPI-D) countries in nominal and real terms as seen in the table below, indicating a slight loss in external competitiveness against these trade baskets of currencies for the said period.