By Francis Allan L. Angelo

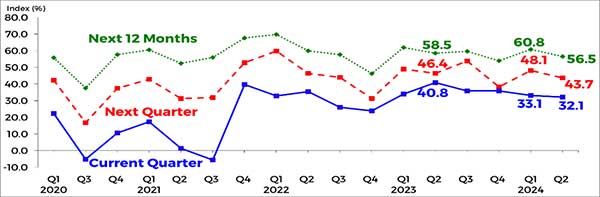

The business sentiment in the Philippines has turned less optimistic for the second quarter of 2024, with the overall confidence index (CI) declining to 32.1 percent from 33.1 percent in Q1 2024.

The decline is due to a combined decrease in the percentage of optimists and an increase in pessimists.

Firms are concerned about softer demand for goods and services, ongoing international conflicts pushing oil prices higher, El Niño-induced extreme weather conditions slowing business activity, and persistent inflationary pressures.

For the third quarter of 2024, business confidence weakened further as the overall CI fell to 43.7 percent from 48.1 percent in Q1 2024.

The outlook for the next 12 months (May 2024-April 2025) remains subdued, with the CI decreasing to 56.5 percent from 60.8 percent in the previous survey.

Sentiment across all sectors is mixed for Q2 2024. Compared with Q1 2024, business sentiment in the industry and wholesale and retail trade sectors is more upbeat, while it remains less buoyant in the construction and services sectors.

The outlook across all types of trading firms is generally less optimistic, except for importers who are more upbeat.

Capacity utilization in the industry and construction sectors slightly declined in Q2 2024, averaging 72 percent, down from 72.3 percent in Q1 2024.

Firms expect tighter financial conditions and access to credit in Q2 2024, with the financial condition index declining further and credit access turning slightly more negative.

Businesses expect a weaker peso, higher inflation, and increased interest rates in Q2 and Q3 2024. The peso is expected to depreciate against the U.S. dollar in these quarters but may appreciate over the next 12 months.

Inflation and borrowing rates are anticipated to rise in Q2, Q3, and the next 12 months, with the inflation rate expected to average 4.3 percent in Q2 2024, 4.4 percent in Q3 2024, and 4.5 percent over the next 12 months. These rates are above the government’s target range of 2-4 percent for 2024-2025.

Despite the challenges, businesses remain cautiously optimistic about gradual improvements in economic conditions towards the end of 2024 and into 2025, provided inflationary pressures are managed and external conditions stabilize.

View Full Report here: https://www.bsp.gov.ph/Lists/Business Expectations Report/Attachments/22/BES_2qtr2024.pdf

The Q2 2024 BES was conducted during the period 5 April – 23 May 2024. There were 1,526 firms surveyed nationwide, consisting of 582 companies in the NCR and 944 firms in AONCR, covering all 16 regions nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2017 from the Bureau van Dijk (BvD) database. The nationwide survey response rate for Q2 2024 was lower at 61.1 percent (from 60.3 percent in Q1 2024). The response rate was slightly lower for the NCR at 60.0 percent (from 60.2 percent) but higher for the AONCR at 61.8 percent (from 60.4 percent).