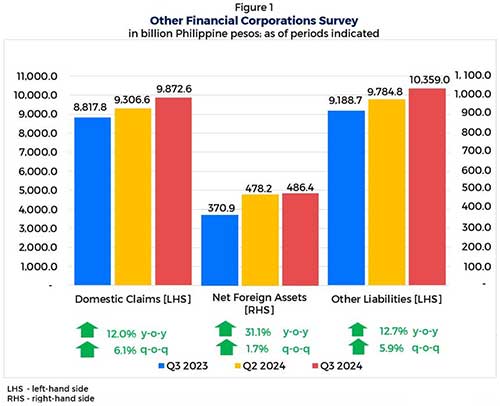

The growth reflects increased claims on depository corporations, other sectors, and the central government, driven by higher investments in bank-issued debt securities, equity shares, and government-issued securities.

“Other financial corporations play a crucial role in supporting the Philippine economy, especially with their sustained investments in critical sectors,” according to the Department of Economic Statistics (DES).

Net foreign assets grew marginally by 1.7 percent q-o-q to ₱486.5 billion due to increased deposits in nonresident banks and investments in nonresident-issued equity shares. Other liabilities rose by 5.9 percent q-o-q to ₱10,359.0 billion, mainly from the issuance of shares and other equity.

On a y-o-y basis, net foreign assets saw a 31.1 percent increase, while other liabilities climbed 12.7 percent, reflecting the sector’s growing financial depth.

Key Contributors to Growth

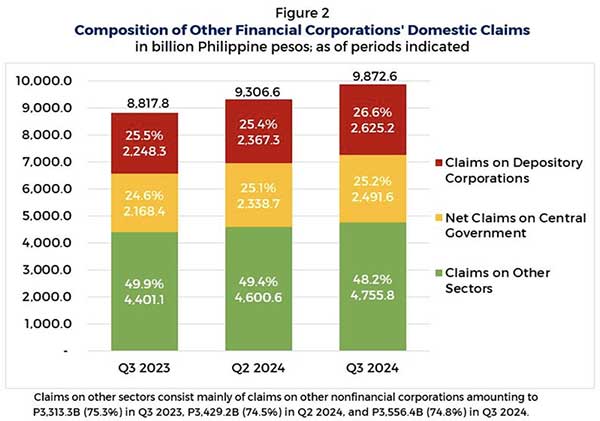

OFCs’ claims on other sectors, including private and public nonfinancial corporations and households, formed the largest portion of domestic claims in Q3 2024.

The DES noted that increased loans to households and investments in equity shares issued by nonfinancial corporations drove the rise in claims.

Investments in government-issued securities also boosted claims on the central government, supporting public sector financing.

Significant Expansion Since 2017

Since Q1 2017, the domestic claims of OFCs have grown by 96.2 percent, underscoring the sector’s expanding role in the economy. Meanwhile, other liabilities rose by 106.3 percent during the same period, driven by equity issuance and fund management.

OFCs include non-money market investment funds, financial auxiliaries, insurance corporations, pension funds, and other financial intermediaries.

The DES emphasized the importance of monitoring OFCs’ activities to ensure balanced growth and effective policy support for the financial sector.