Finance Secretary Benjamin E. Diokno briefed the Korean business community on the Philippines’ improved investment environment during the first-ever Korea-Philippines Forum on the Ease of Doing Business on October 6, 2023 at the Department of Finance (DOF) office in Manila.

The Forum, jointly organized by the DOF and the Embassy of the Republic of Korea to the Philippines, allowed representatives of the Philippine government to engage in dialogue with the Korean business community in order to further enhance the country’s ease of doing business, particularly in trade, investments, tax policies and administration, customs, and licensing.

“In recent years, we actively pursued game-changing measures to promote the participation of international players in the Philippines’ economic transformation journey,” Secretary Diokno said, citing the country’s economic liberalization measures.

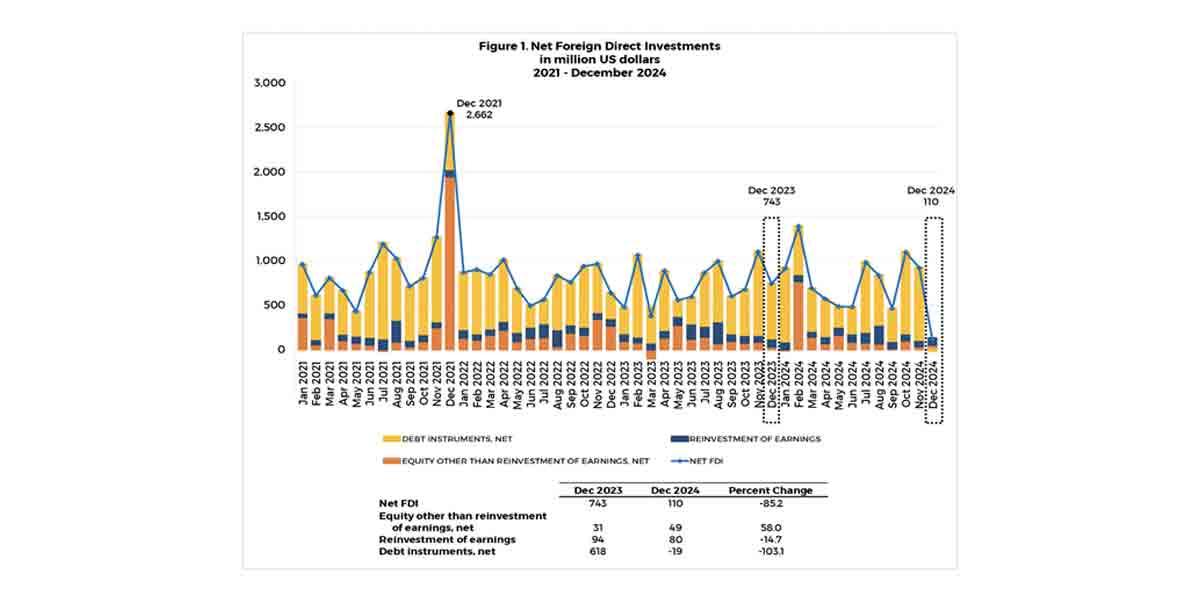

He detailed the amendments to the Retail Trade Liberalization Act, Foreign Investments Act, and Public Service Act which aim to attract more foreign direct investments into the Philippines. The government has also opened up renewable energy to full foreign ownership.

“We are also working aggressively towards easing regulatory burdens and enhancing transparency to create a more attractive business environment for both local and foreign investors,” Secretary Diokno said.

Just recently, the Public-Private Partnership (PPP) Code was approved in the Congress. Once enacted, the PPP Code will enhance the current Build-Operate-Transfer (BOT) Law and simplify the regulations and procedures on infrastructure projects in order to establish a stable and predictable environment for PPPs to flourish.

President Ferdinand R. Marcos, Jr. also issued Executive Order (EO) 18, establishing green lanes to enhance the ease of doing business in the country by expediting, streamlining, and automating government processes across all government offices for investments under the Strategic Investment Priority Plan (SIPP).

Furthermore, Secretary Diokno informed Korean investors that enterprises undertaking priority investments can avail of tax incentives under the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, which provides for a 40-year tax incentive package for highly desirable projects or activities with investment capital of at least PHP 50 billion (about US$ 883 million).

“As we pursue more investment- and business-friendly policies, we intend to continue taking bold steps to elevate the Philippines’ status as a premier investment destination in the region,” Secretary Diokno said.

Ambassador of the Republic of Korea to the Philippines Lee Sang-hwa and representatives from the Korea Trade-Investment Promotion Agency (KOTRA), Korean Companies Association Philippines (KCAPH), Industrial Bank of Korea (IBK), LG Electronics, Hyundai E&C, SFA Semicon Philippines Corp. (SSPC), Pepsi-Cola Products Philippines Inc. (PCPPI), Hyundai E&C, Samsung Electro-Mechanics Philippines (SEMPHIL) raised their concerns to officials from the DOF, Department of Labor and Employment (DOLE), Bureau of Customs (BOC), Bureau of Internal Revenue (BIR), Anti-Red Tape Authority (ARTA), and Fiscal Incentives Review Board (FIRB).