The Philippines’ inflation rate remained steady at 2.9% in January 2025, unchanged from the previous month and well within the government’s target range of 2-4%, according to data released by the Philippine Statistics Authority (PSA).

This stable inflation rate reflects the government’s continued efforts to maintain price stability while addressing risks to food security and economic growth.

According to the Bangko Sentral ng Pilipinas (BSP), core inflation—which excludes volatile food and energy items—eased to 2.6% from 2.8% in December 2024. The central bank sees this as an indication that inflation remains well-anchored and expects it to stay within target for the rest of the year.

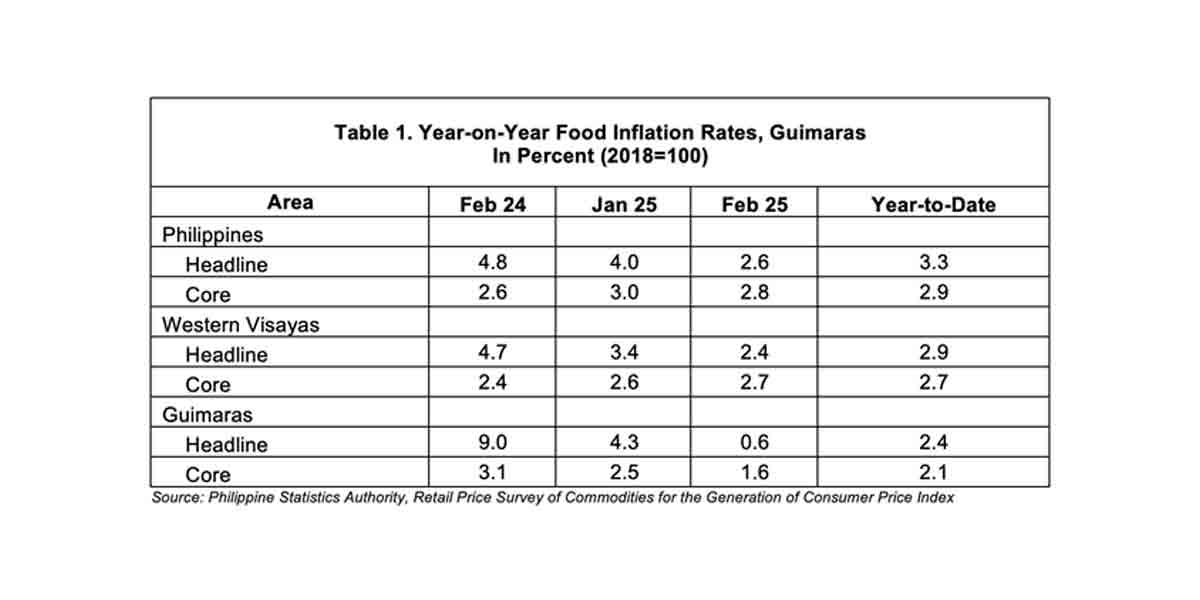

FOOD PRICES RISE

Food inflation increased to 4.0% in January, up from 3.5% in December, largely due to the lingering effects of last year’s typhoons, which disrupted the supply of vegetables, tubers, and bananas. These commodities saw a steep price surge of 21.1% compared to 14.2% the previous month.

The Department of Agriculture (DA) warned that food prices could face further volatility in the coming months, with the Philippine Atmospheric, Geophysical, and Astronomical Services Administration (PAGASA) predicting the arrival of four to ten tropical cyclones between February and July 2025.

To counter this, the DA has implemented several measures, including the release of rice buffer stocks through the Kadiwa ng Pangulo program and the provision of submergence-tolerant and early-maturing seed varieties to farmers.

Agriculture officials also intensified the ongoing vaccination campaign against African Swine Fever (ASF) and are working closely with the Food and Drug Administration (FDA) to expedite the approval of the Avian Influenza vaccine. The agency is securing PHP 300 million in funding to support vaccine testing, expected to commence in March 2025.

RICE PRICES DECLINE

Despite the overall rise in food prices, rice inflation recorded a deflation of -2.3% year-on-year in January, a welcome relief for consumers following months of price volatility.

The government attributes the decrease to ample domestic supply and the continued arrival of imports levied with lower tariffs. To further stabilize prices, the DA lowered the maximum suggested retail price (MSRP) of imported rice in Metro Manila from PHP 58 per kilogram to PHP 55 per kilogram, effective February 5, with a nationwide rollout by February 15.

Finance Secretary Ralph G. Recto underscored the importance of keeping rice prices affordable, stating, “This is a welcome relief for Filipino consumers. But rest assured, the government will not be complacent. We will remain proactive in implementing interventions to ensure stable and affordable rice prices.”

LOWER ELECTRICITY RATES

Non-food inflation, which includes housing, electricity, water, and fuel costs, moderated to 2.2% in January from 2.9% in December. Lower electricity rates played a crucial role in this decline.

The Maharlika Investment Corporation (MIC), in partnership with the Department of Energy (DOE), anticipates that the government’s investment in the power transmission sector will help bring down electricity costs through lower transmission charges.

“The government’s investment in energy infrastructure aims to lower power rates for consumers while ensuring a stable electricity supply,” an energy department official stated.

Manila Water Co., Inc. also began implementing an enhanced lifeline program in January, offering higher discounts to low-income customers to ensure affordable access to essential water services.

VIGILANT

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan emphasized that the government remains committed to stabilizing prices while achieving economic growth targets under the Philippine Development Plan (PDP) 2023-2028.

“President Marcos has emphasized that there should be no room for complacency as we work toward our targets this year and in the medium term,” Balisacan said.

“We remain vigilant and proactive in anticipating and addressing future developments, whether upside or downside risks, unforeseen or otherwise. The resiliency of our agri-food systems will be one of our most important goals to ensure low and stable prices for all Filipinos.”

NEDA highlighted that while food inflation contributed 1.5 percentage points to the overall inflation rate, its impact was offset by the lower inflation in housing, water, electricity, gas, and fuels (2.2% from 2.9%), restaurants and accommodation services (3.2% from 3.8%), and clothing and footwear (2.3% from 2.4%).

INTEREST RATES CUT

The steady inflation rate gives the BSP room to consider cutting policy interest rates, which could help boost household spending and investments.

Finance Secretary Recto said, “Magandang balita ito. This is a strong indicator of the government’s commitment to keeping prices stable and signals that the BSP has more flexibility to further reduce interest rates. Lower interest rates mean cheaper borrowing costs for our consumers and businesses. This will provide greater purchasing power for our people and stronger momentum for investments and growth.”

With global economic uncertainty still looming, a potential rate cut by the BSP could support economic expansion, particularly in the consumer, housing, and business investment sectors.

NEW MEASURES

To address both food and non-food inflation, the government is implementing several key interventions:

- Rice Price Stabilization – The Department of Agriculture (DA) has declared a food security emergency, allowing the release of National Food Authority (NFA) buffer stocks at lower prices to selected agencies and consumers through Kadiwa ng Pangulo sites.

- Agricultural Resilience Initiatives – The DA is rolling out La Niña preparedness measures, including water management system rehabilitation, subsidies for resilient crop varieties, and enhanced farming diversification programs.

- Energy Sector Investments – The Maharlika Investment Corporation (MIC) and Department of Energy (DOE) are investing in the National Grid Corporation of the Philippines (NGCP) to reduce transmission charges, thereby lowering electricity costs.

- Affordable Water Access – Manila Water is expanding its lifeline program to help ensure lower water rates for the most vulnerable sectors.

Despite ongoing challenges, the BSP remains confident that inflation will remain within the 2-4% target range throughout 2025.