By Francis Allan L. Angelo

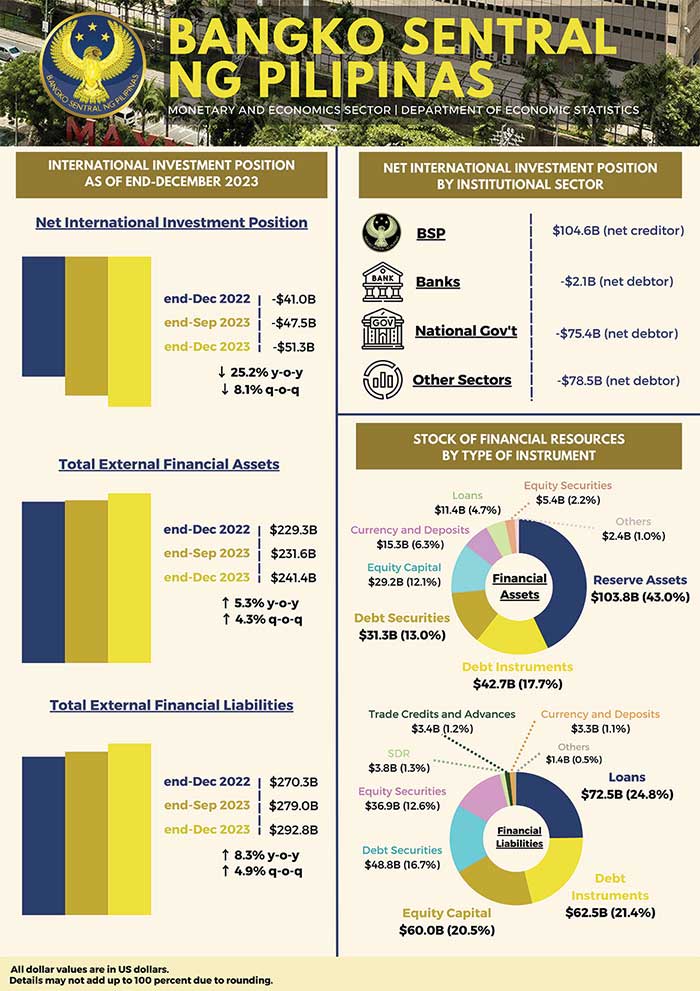

As 2023 came to a close, the Philippines faced a notable financial challenge: the country’s net external liability position escalated to $51.3 billion by the end of December, marking an 8.1% increase from the $47.5 billion tallied at the end of September.

The uptick, highlighted in the latest Bangko Sentral ng Pilipinas (BSP) report, stems from a 4.9% expansion in the nation’s external financial liabilities, which outstripped the growth of external financial assets, ending the fourth quarter at $292.8 billion and $241.4 billion, respectively.

A detailed look into the Philippines’ financial standings revealed that the rise in external financial liabilities was comprehensive, sparing only financial derivatives.

Notably, other investments such as foreign loans surged by 7.9% to $72.5 billion.

Foreign portfolio investment also swelled, fueled by a strong appetite for bond offerings from the National Government.

Foreign direct investment was not left behind, registering a 3.7% increase to $122.6 billion.

The country’s external financial assets saw substantial growth, primarily due to the swelling of reserve assets which reached $103.8 billion.

This rise was attributed to several factors, including the BSP’s foreign currency-denominated reserve assets, gold holdings, net foreign currency deposits with the BSP, net income from BSP’s investments abroad, and the central bank’s foreign exchange operations.

Direct investments abroad in debt instruments and currency and deposits in banks abroad also saw significant increases.

Reflecting on the past year, the net external liability position had expanded by a notable 25.2% from $41.0 billion at the end of 2022. This was largely due to a $22.5 billion increase in total external financial liabilities, significantly outpacing the $12.2 billion rise in total external financial assets.

Investors’ confidence in the Philippine economy is evident from the growth in both foreign direct investment and foreign portfolio investment. These reflect not only the global interest but also signal improved domestic inflation dynamics and economic resilience.

The BSP continued to hold a significant portion of the country’s external financial claims, registering a 5.9% increase to $108.5 billion, and making up nearly half of the country’s total external financial assets.

The Other Sectors accounted for a sizable 41.0%, with the remaining held by the Banks.

Conversely, the Other Sectors were responsible for the majority of the country’s external financial liabilities, at 60.6%.

The National Government’s liabilities also grew, now representing 25.7% of the total, while the Banks’ share was 12.3%, and the BSP maintained a marginal 1.3%, primarily in Special Drawing Rights (SDRs).

View Full Report: https://www.bsp.gov.ph/Media_And_Research/International%20Investment%20Position/IIP4qtr2023.pdf