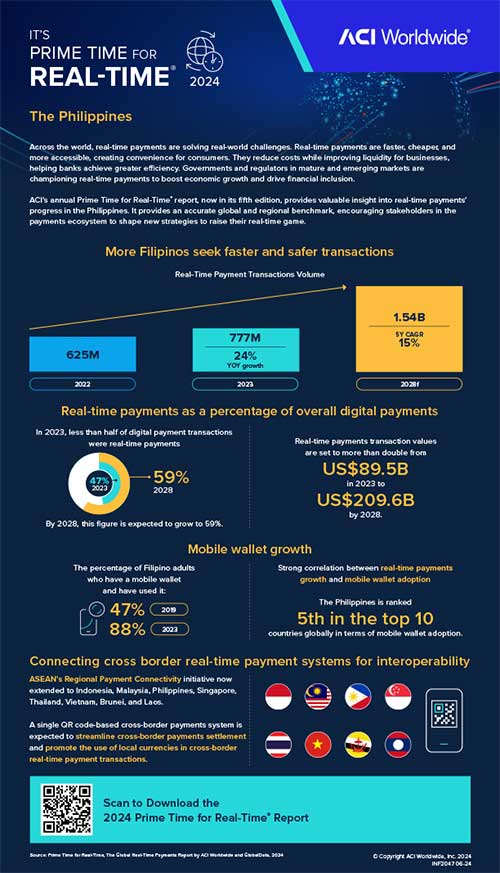

The Philippines experienced a significant boost in real-time payment transactions in 2023, growing by 24% year-on-year, with total transactions reaching 777 million.

The trend is expected to continue, with projections indicating the volume will double to 1.54 billion by 2028. The findings were revealed in the 2024 Prime Time for Real-Time Report published by ACI Worldwide, in collaboration with GlobalData, a leading data and analytics company.

Real-time payments, defined as instant fund transfers available 24/7, accounted for 47.2% of all digital payments in the country in 2023, with a transaction value of USD 89.5 billion. This is projected to grow to 58.7% of all digital payments by 2028, with the value soaring to USD 209.6 billion.

The introduction of InstaPay in 2018 marked the beginning of real-time payment systems in the Philippines. The initiative was part of the Bangko Sentral ng Pilipinas (BSP) Digital Payments Transformation Roadmap, aimed at digitizing payments.

The subsequent launch of QR Ph in November 2019 further propelled the use of real-time payments by enabling easy person-to-person fund transfers via QR codes.

Leslie Choo, Senior Vice President and Managing Director for APAC at ACI Worldwide, highlighted the broader economic implications: “Real-time payments hold the potential to facilitate greater economic growth and financial inclusion in the Philippines by eliminating payment friction and injecting greater liquidity in the financial system. As Filipinos continue to embrace digitization, we encourage the local banks and financial institutions to harness technological innovations that will enable them to fully leverage the capabilities of real-time transactions.”

The COVID-19 pandemic accelerated the shift towards digital and cashless payments in the Philippines. The report indicates that the demand for faster, simpler, and more secure transactions has been a major driver for the adoption of digital payment tools among Filipinos.

The correlation between real-time payments growth and mobile wallet adoption is strong, with the Philippines ranking fifth globally for mobile wallet usage. ACI Worldwide’s report states that 88% of Filipinos used a mobile wallet in the past year, leveraging QR codes, mobile wallets, and bank accounts to initiate real-time payments.

Regional Integration and Future Prospects

In line with its strategy to promote financial inclusivity, the BSP plans to join the Regional Payment Connectivity initiative. This aims to link all ASEAN countries under a single QR code-based system, presenting new opportunities for real-time cross-border payments.

The initiative could potentially reduce remittance costs and boost the Philippine economy.

Choo emphasized the need for continued innovation: “Real-time payments are now a real-world reality and banks have the opportunity to innovate where real-time payment sits in the customer journey and the end-to-end payments landscape to provide a differentiated experience. At ACI Worldwide, we want to collaborate with banks, merchants, and billers in the Philippines and around the world to enable them to tap into emerging use cases of real-time payments through payment modernization and transformation.”

Global Context

Globally, ACI Worldwide supports 26 domestic and pan-regional real-time payment schemes across six continents, including 10 central infrastructures. The company’s solutions cater to central banks, participant banks, fintechs, and other payment service providers.

The rapid growth in real-time payments in the Philippines signifies a broader trend towards digital financial solutions, promising enhanced economic growth and financial inclusivity in the years to come.