By Francis Allan L. Angelo

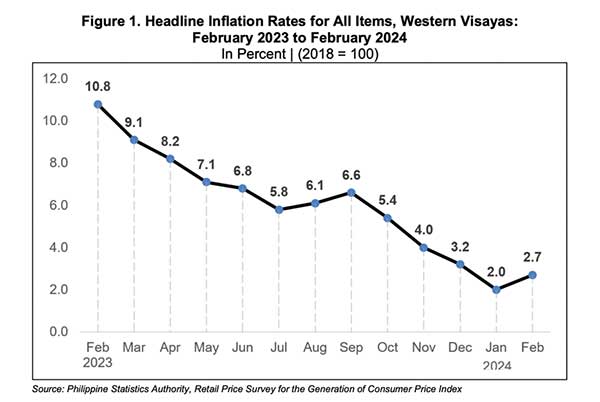

Inflation in Western Visayas accelerated in February 2024, based on data from the Philippine Statistics Authority (PSA).

A special release from the PSA indicated that headline inflation rate last month was at 2.7% against 2.0% in January but far from the staggering 10.8% experienced a year prior.

Headline inflation is a measure of the total inflation or upward movement of prices within an economy. It includes commodities such as food and energy prices (e.g., oil and gas), which tend to be much more volatile and prone to inflationary spikes.

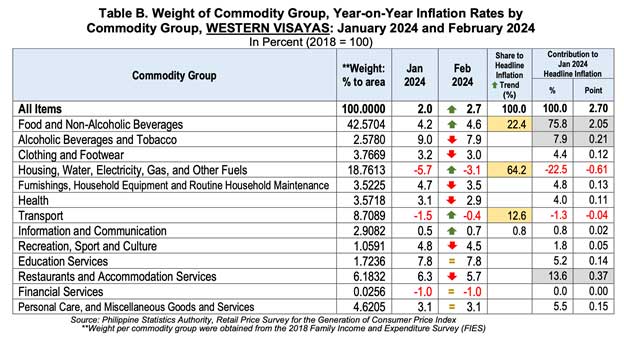

One of the main factors contributing to this uptrend is the notable deceleration in the decline of the Housing, Water, Electricity, Gas, and Other Fuels index, which saw a -3.1% inflation rate in February 2024, compared to -5.7% in the previous month.

Additionally, the Food and Non-Alcoholic Beverages sector posted a faster annual growth of 4.6% in February, up from 4.2% in January, signaling a shift in consumer price movements that directly affects the daily lives of residents.

The annual decline in the Transport sector was slower at -0.4% inflation rate in February against -1.5% in January.

Conversely, six commodity groups experienced lower inflation rates during the month, including Alcoholic Beverages and Tobacco, Clothing and Footwear, and Health, among others.

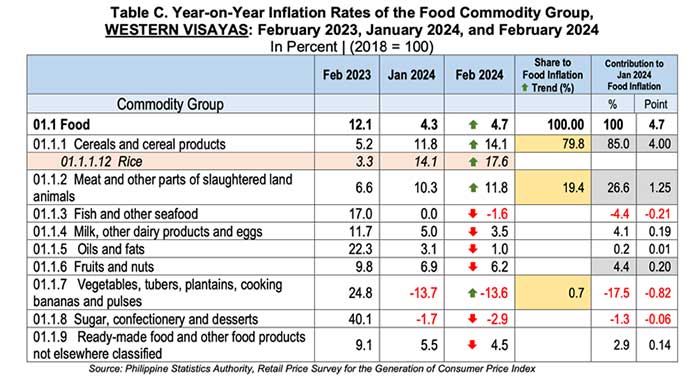

Food inflation stood out with a 4.7% increase, driven primarily by Cereals and Cereal Products, including staple foods such as rice, corn flour, and bread.

Meat and Vegetables also played significant roles in this rise. In contrast, Fish and Seafood, along with Fruits and Nuts, experienced lower annual growth rates.

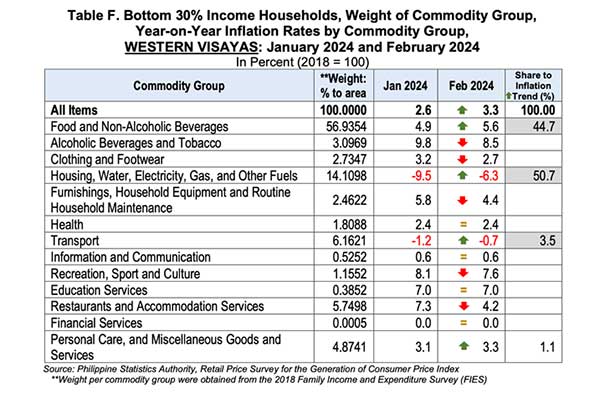

The report also sheds light on the inflation experienced by the bottom 30% income households in Western Visayas, which accelerated to 3.3% in February from 2.6% in January.

This group felt the impact of inflation more acutely, with Housing, Water, Electricity, Gas, and Other Fuels, and Food and Non-Alcoholic Beverages being the primary contributors to this trend.

Regionally, all six provinces in Western Visayas recorded uptrends in inflation rates in February 2024, with Guimaras experiencing the highest monthly inflation rate of 5.9% and Iloilo the lowest at 2.1%.

Both highly urbanized cities in the region also registered acceleration in their inflation rates during the month. Iloilo City monthly inflation rate is at 0.4 percent from -1.1 percent in January 2024. Bacolod City monthly inflation rate is noted at 3.1 percent, from 2.5 percent in the previous month.

The rising costs have prompted mixed reactions from local residents and business owners. Maria, a local grocery store owner in Iloilo City, shared her perspective, stating,

“While we’ve seen a slight improvement in sales due to lower inflation, the fluctuating prices of goods, especially food items, still pose challenges in managing inventory and setting prices that won’t deter customers,” a grocery store told Daily Guardian.

On the consumer side, a father of three, said things are getting tighter on their end.

“Though inflation has slowed down from last year’s peak, our household expenses, especially for food and utilities, remain a significant part of our budget. Every percentage point increase in inflation directly impacts how much we can save or spend on non-essential needs.”

“Every day, it’s getting harder to stretch our budget to meet our basic needs,” shared Marian Lopera, a local market vendor. “The prices of rice, vegetables, and meat keep going up, but our income doesn’t. We’re cutting back on everything except food.”

PURCHASING POWER

The purchasing power of the peso in the Western Visayas region of the Philippines has decreased over time, as indicated by inflation data.

As of February 2024, one peso from the base period of 2018 is equivalent to 78 centavos. This demonstrates that over the course of six years, the value of the peso in terms of what it can purchase has declined by 22%, as the consumer price index (CPI) has increased, reflecting higher prices for goods and services.

The decline in the peso’s purchasing power is a direct consequence of inflation, which is the rate at which the general level of prices for goods and services is rising, and, subsequently, eroding the purchasing power of money.

When inflation is positive and persistent, as it appears to have been in the Western Visayas, the cost of living increases, which means that the peso does not go as far as it used to in buying goods and services.

This is a normal economic phenomenon over time; however, the rate at which it occurs can vary greatly and is influenced by various economic factors. For instance, significant changes in inflation can arise from shifts in demand and supply, government fiscal policy, monetary policy, and other external economic shocks.

Understanding the purchasing power of the peso is essential for consumers, businesses, and policymakers. For consumers, it affects their real income and their ability to purchase goods and services. For businesses, it influences pricing, wages, and investment decisions.

Policymakers, particularly the central bank, monitor purchasing power closely to set monetary policy that can help manage inflation and support the economy’s overall health.

To maintain the peso’s purchasing power, the Bangko Sentral ng Pilipinas (BSP) aims to keep inflation at manageable levels through monetary policy tools, ensuring that liquidity in the market is aligned with the country’s economic growth and financial stability objectives. This involves managing interest rates and bank reserves to control the money supply in the economy.

The decrease in purchasing power also underscores the importance of investment and savings strategies that can provide returns above the rate of inflation, preserving and potentially increasing the real value of savings over time. Without such strategies, money held in cash or in savings with low-interest rates could lose real value as the cost of living increases.