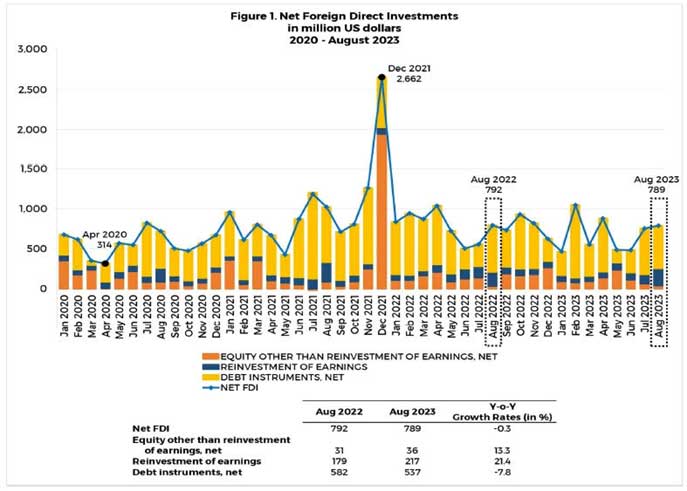

Foreign direct investment (FDI) posted net inflows of US$789 million in August 2023, slightly lower than the US$792 million net inflows recorded in the same month last year (Figure 1).1,2

The marginal decline in FDI net inflows reflected the 7.8 percent contraction in nonresidents’ net investments in debt instruments to US$537 million from US$582 million in August 2022.3

This was tempered partly by the expansion in nonresidents’ net investments in equity capital (other than reinvestment of earnings) by 13.3 percent to US$36 million from US$31 million, and their reinvestment of earnings by 21.4 percent to US$217 million from US$179 million.

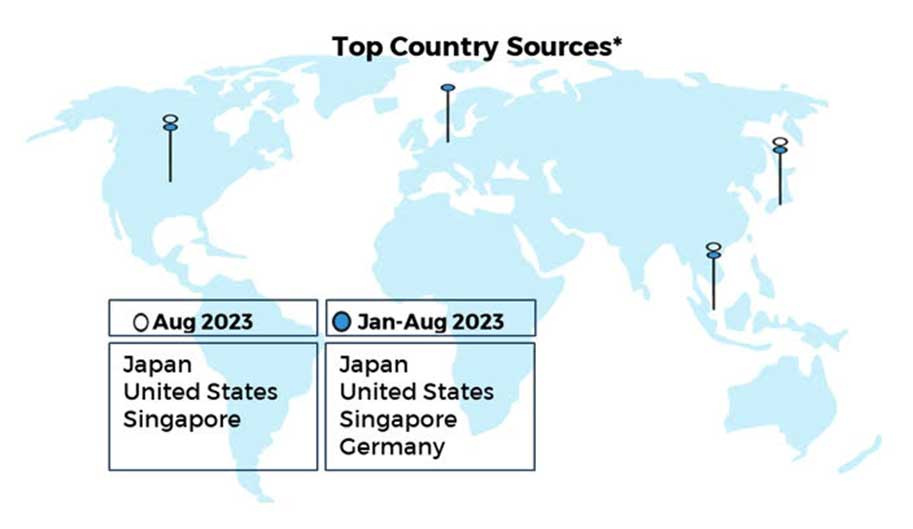

During the reference month, equity capital placements emanated mostly from Japan, the United States, and Singapore. These were channeled primarily to the 1) manufacturing; 2) wholesale and retail trade; and 3) information and communication industries.

The year-to-date FDI net inflows amounted to US$5.5 billion, a 12.9 percent decline from the US$6.3 billion recorded in the same period last year (Figure 2). The continued FDI net inflows reflect the country’s strong macroeconomic fundamentals. Nonetheless, the recorded slowdown may be due largely to investor concerns following the sustained uncertainty surrounding the global economy.

1 The BSP statistics on FDI are compiled based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). FDI includes (a) investment by a nonresident direct investor in a resident enterprise, whose equity capital in the latter is at least 10 percent, and (b) investment made by a nonresident subsidiary/associate in its resident direct investor. FDI can be in the form of equity capital, reinvestment of earnings, and borrowings.

2 The BSP FDI statistics are distinct from the investment data of other government sources. BSP FDI covers actual investment inflows. By contrast, the approved foreign investments data that are published by the Philippine Statistics Authority (PSA), which are sourced from Investment Promotion Agencies (IPAs), represent investment commitments, which may not necessarily be realized fully, in a given period. Further, the said PSA data are not based on the 10 percent ownership criterion under BPM6. Moreover, the BSP’s FDI data are presented in net terms (i.e., equity capital placements less withdrawals), while the PSA’s foreign investment data do not account for equity withdrawals.

3 Net investments in debt instruments consist mainly of intercompany borrowing/lending between foreign direct investors and their subsidiaries/affiliates in the Philippines. The remaining portion of net investments in debt instruments are investments made by nonresident subsidiaries/associates in their resident direct investors, i.e., reverse investment.