Mathematicians from the Ateneo de Manila University have developed artificial intelligence (AI) deep learning tools that can help predict money market interest rates, invaluable for decision-makers in business and government.

In simple terms, the market interest rate is the cost of borrowing money or the reward for saving it.

This rate changes based on supply and demand: if many people are borrowing but few are saving, rates go up; if the opposite happens, rates go down.

Interest rates are also affected by inflation (since higher prices mean higher rates) as well as by countries’ central banks (which adjust rates to help the economy grow or to control rising prices). Essentially, interest rates help determine how money moves in the economy.

“Interest rates are among the most important macroeconomic factors considered by both government and private entities when making investment and policy decisions. A reliable forecast is a requisite to sound management of exposure to different types of risk,” the researchers explained.

The Ateneo researchers tested two deep learning models: Multi-layer Perceptrons (MLP) and Vanilla Generative Adversarial Networks (VGAN).

Both successfully anticipated changes in Philippine Benchmark Valuation (BVAL) rates before and during the pandemic, showcasing the models’ robust capability to potentially foresee economic fluctuations and market disruptions.

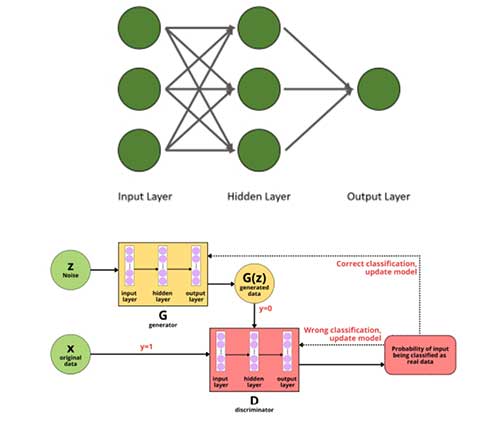

MLP is a type of artificial neural network that passes the data through a series of cells, each of which processes the information in its own way and adds to the network’s overall understanding of the data. This method is often used for image recognition and machine translation because of its ability to find complex patterns in data.

Meanwhile, VGAN actually consists of two networks: a generator that creates synthetic data, and a discriminator that evaluates the data’s authenticity. By working in opposition to each other—hence, “adversarial”—the networks are able to refine and improve their analyses.

The researchers found that both models produced reliable forecasts of one-, three-, six-month, and one-year BVAL rates within the limits of the datasets used. They successfully predicted key trends by incorporating as many as 16 domestic and global economic indicators, including inflation, exchange rates, and credit default swaps.

MLP showed strong performance with fewer variables and simpler structures, making it an efficient choice for straightforward analyses. Meanwhile, VGAN excelled more in analyzing complex scenarios, achieving high accuracy when working with larger datasets.

The practical implications of these AI deep learning models are substantial, according to the researchers: financial institutions could potentially deploy them to manage market, credit, liquidity, and other risks; and governments could also potentially use these models to optimize debt issuance strategies by reducing borrowing costs.

The study highlights the growing role of AI in financial decision-making and suggests exploring more advanced neural network designs to further enhance forecasting accuracy. It is hoped that businesses and policymakers will come to embrace these technologies in order to gain a competitive advantage in a rapidly evolving data-driven landscape.

Halle Megan L. Bata, Mark Jayson A. Victoria, Wyonna Chezska B. Alvarez, Elvira P. de Lara-Tuprio, and Armin Paul D. Allado published their paper, “Deep Learning Approaches in Interest Rate Forecasting,” last November 15 in the journal, AIP Conference Proceedings. (SOURCE: https://archium.ateneo.edu/mathematics-faculty-pubs/288/)