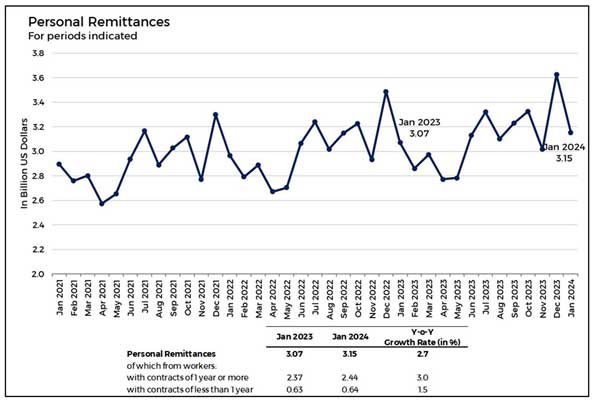

Personal remittances from Overseas Filipinos (OFs) registered US$3.15 billion in January 2024, higher by 2.7 percent than the US$3.07 billion recorded in the same month last year.

The increase in personal remittances in January 2024 was driven by increased remittances from 1) land-based workers with work contracts of one year or more and 2) sea- and land-based workers with work contracts of less than one year

Figure 1

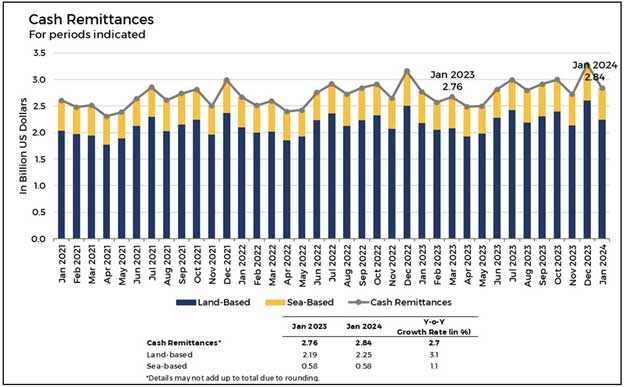

Of the personal remittances from OFs, cash remittances coursed through banks increased by 2.7 percent to US$2.84 billion in January 2024 from US$2.76 billion registered in the comparable month a year ago. The growth in cash remittances in January 2024 was primarily due to increased receipts from both land- and sea-based workers.

Figure 2

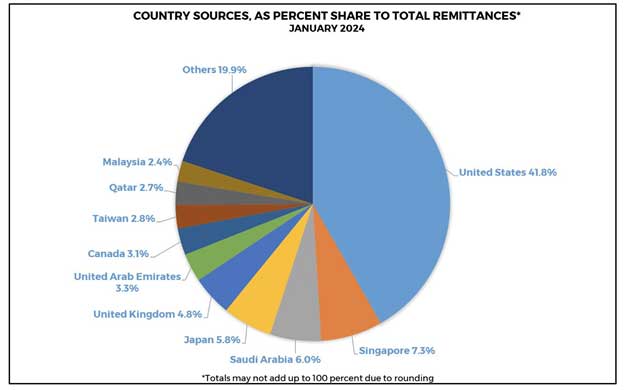

The growth in cash remittances from the United States (U.S.), Saudi Arabia, the United Arab Emirates (U.A.E), and Singapore contributed mainly to the increase in remittances in January 2024. In terms of the countries where these remittances originated, the U.S. had the highest share of overall remittances during the period, followed by Singapore and Saudi Arabia.[1]

Figure 3

[1] There are some limitations on the remittance data by source. A common practice of remittance centers in various cities abroad is to course remittances through correspondent banks, most of which are located in the U.S. Also, remittances coursed through money couriers cannot be disaggregated by actual country source and are lodged under the country where the main offices are located, which, in many cases, is in the U.S. Therefore, the U.S. would appear to be the main source of OF remittances because banks attribute the origin of funds to the most immediate source. The countries are listed in order of their share of cash remittances, i.e., from highest to lowest.